Interview with the President

-

Please explain the main causes for the Company falling short of its initial targets for the fiscal year ended in March 2014 and what the Company is doing to address those issues.

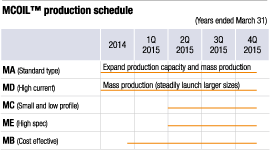

The reasons we fell short of our targets were twofold; 1) we had an insufficient lineup of MCOIL™ metal power inductors, and 2) the mistimed development of SAW/FBAR devices for mobile communications. We have already addressed the causes of these problems and are fully prepared to implement solutions to these issues in the current fiscal year, which ends March 2015.

MCOIL™ is a promising super high-end product that is the solution for increasingly compact, thinner, and larger-current digital electronics. We were unable to increase MCOIL™ sales as planned. Sales were impacted by our insufficient product lineup and a much steeper than expected decline in the production volumes of devices that use our products. Furthermore, we missed business opportunities because we were too slow in bringing MCOIL™ to market. For SAW/FBAR devices, we were unable to develop timely products in pace with the rapidly expanding market for communications devices, which is driven by the proliferation of smartphones and increasingly higher speed data communications.

There is also a concern on an over emphasis of the belief that leading-edge products sell automatically. In reality, no matter how outstanding a product is, it will not sell unless it meets customers' quality and pricing needs and the product must be made available in a timely manner that meets the customer's schedule expectations. As a management executive, I am particularly concerned that this may have contributed to the situation.

-

The introduction of MCOIL™ series took six months longer than we had planned. We are now preparing for high volume production to address this head on with all of our MCOIL™ product variations. We also established the TAIYO YUDEN Mobile Technology Ome Operation Center in April 2014 to enhance our operating efficiency and create a manufacturing structure with the ability to quickly respond to the growing demand for communications devices.

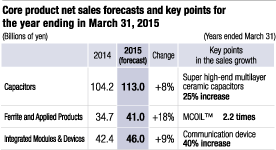

In the fiscal year ending in March 2015, we project MCOIL™ sales to grow 2.2 times and communication device sales growing 40% year over year.

*Please see the “Special Feature,” page 14, for further details about our communications devices.

-

What are your earnings forecast and growth strategies for the fiscal year ending in March 2015?

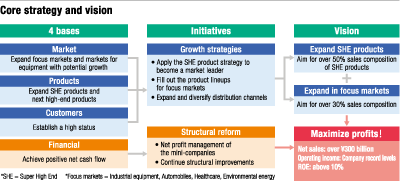

We expect to have increases in both sales and profit in the fiscal year ending in March 2015 as we steadily progress toward fulfilling our corporate vision by implementing growth strategies to strengthen our market, product, and customer bases with a fortified financial base.

In the fiscal year ending in March 2015, we forecast an increase in net sales by 5.7% year over year to ¥220.0 billion, operating income will increase by 23.3% year over year to ¥14.0 billion, and net income is projected to grow by 21.6% year over year to ¥8.5 billion. We have also created a very clear corporate vision for the Company. Despite being an electronic components manufacturer in Japan, commanding 40% of the global market, and boasting a number of world-leading technologies, we are still viewed as having a market base that is dependent on business conditions, a product base that is prone to pricing competition, a customer base that makes us seen as a Tier 3 supplier out of range of the top two tier groups with a fragile financial base. We are confident and determined to turn this assessment around 180 degrees in right direction by persevering with our reform efforts and continuing to produce results.

-

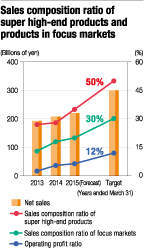

We will continue the expansion of the sales composition ratios of our high value-added super high-end products to 50% and of our focus markets, including automobile electronics, industrial equipment, medical and healthcare, and environmental and energy, to 30%. By changing our main evaluation benchmark from operating income to net profit, implemented during the year ended in March 2014, we created a framework with established mini-companies in each of our business domains that are empowered to act independently and pursue positive results. This allows each group and the TAIYO YUDEN group as a whole to optimize sales and marketing decision making that drives an efficient utilization of our resources and facilities. Now that we have established our new structure we will focus on gaining a positive net cash flow and construct a solid financial base.

-

How do you develop the focus markets to overcome the reliance on business conditions?

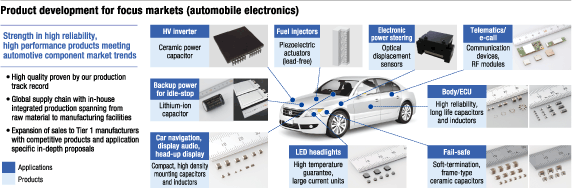

We have created a lineup of competitive products for the automotive and other industries and we are now supplying Tier 1 manufacturers (direct suppliers to original equipment manufacturers.)

TAIYO YUDEN is highly respected for its technological developments, product competitiveness, and proposal capabilities that we have cultivated in consumer markets, automobile electronics, industrial equipment, medical and healthcare, environmental and energy, and other markets. These fields continue to increase the use of electronics technology and we are positioned to take advantage of these new market demands. We have assembled a lineup of highly reliable products matched to the various needs of the automotive industry and are ready to begin supplying components to Tier 1 manufacturers. We see significant synergies with the new markets we are entering and our traditional consumer products markets. TAIYO YUDEN is capable of highly efficient development and manufacturing of products that have common basic designs and processes with consumer products. Moreover, we have highly competitive pricing advantages with such products. We have been already selected as a component supplier of parts in automobile power trains, which conveys engine power that moves the vehicle and is considered to be the most difficult to produce.

-

We are also progressing with commercialization of products for the industrial equipment, healthcare, environmental and energy markets, including energy regeneration systems for electric bicycles and other equipment, wireless sensor networks used to detect strain and vibrations in bridges and buildings, and power control systems that improve the efficiency of solar power generation systems. We project the sales composition ratio of products for these focus markets to increase from 13% in the fiscal year ended in March 2013 to 20% in the fiscal year ending in March 2015.

-

How will TAIYO YUDEN strengthen its sales and production structures to achieve growth in the future?

We will strengthen our structure by putting our corporate roadmap on a parallel vector matching to the trends in the markets we serve.

We expect higher demand for greater functionality and expanding markets for smartphones, tablet devices, and other products with growth potential to lead to increasing use of super high-end products. Major set makers are developing global operations and Chinese companies gain momentum. These manufacturers will continue the steady rollout of new models with highly concentrated periods of mass production. Amid this environment, suppliers of electronic components, including TAIYO YUDEN, are at risk to miss business opportunities and to quickly confront pricing competition even with our super high-end products. To address this risk we must be quick to market with product development and in establishing a system for high-volume production.

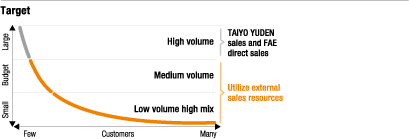

Our strategic approach and related actions to these conditions is to focus on key equipment and to increase the number of field application engineers (FAEs) working with the customer to quickly identify customer needs and gather information on market trends at customer sites around the world. Our top priorities will be to create a corporate roadmap on a parallel vector with the market trends and be able to provide a steady supply of products that are competitively priced that meet the specifications needed in the market. We will also concentrate our sales staff and FAE's efforts in product volume zones of growth markets to enhance our ability to develop and introduce in-demand products with the focus on flexibility that meets production needs.

-

The first hurdle in successfully entering these new markets will be our ability to obtain a higher recognition level or the TAIYO YUDEN name. To raise our profile, we will strengthen our sales channels in these new markets by increasing the contact points with business partners through our distributors, trading companies, and online traders.

-

What is the Company's approach to providing a proper return to shareholders?

We are constructing a stable and sustainable earnings structure and we are constantly working to improve our financial position. As we aim to realize these objectives, we are seeking to provide profit return to shareholders at a total return ratio of 30%.

TAIYO YUDEN's goal is to become a company that is highly respected by all stakeholders, and we are focusing on the reform of the Company's financial base. This focus is in line with three priority bases— 1) market base, 2) product base, and 3) customer base. The Company's management team is working diligently to implement cash flow management policies that will yield a positive net cash flow in the fiscal year ending March 2016. To realize this, we will fortify our production system and make our main focus super high-end products while maintaining capital investment within the range of depreciation and amortization.

To properly succeed and assure our policies are implemented we are reestablishing a stable and sustainable earnings structure and we will continue to stress the importance of improving our financial position at this stage. Management has therefore determined to distribute total dividends of ¥10 per share from retained earnings, representing a dividend payout ratio of 16.8%, for the fiscal year ended in March 2014.

We are committed to returning profit to our shareholders as we move forward with our plans and related actions to increase sales and profits with positive net cash flow results in the fiscal year ending in March 2015.

This website contains forward-looking statements. These forward-looking statements are not guarantees of future performance, and they involve inherent risks and uncertainties.

A variety of factors including changes in the business environment could cause actual results to differ materially from those in the forward-looking statements.

Copyright TAIYO YUDEN CO., LTD All Rights Reserved.