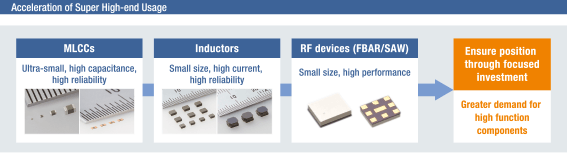

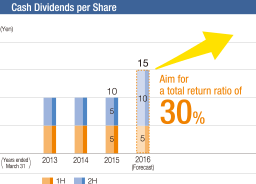

Our product strategies are based on tracking the direction of technology trends and providing products that meet the needs of our customers. We have formulated detailed product strategies for our MLCCs, MCOIL™ metal power inductors, and FBAR/SAW filters for communications devices.

The trend in MLCCs is for smaller, thinner, and larger capacity components. We have already started mass production of the world’s smallest capacitors, the 008004 size (0.25 mm × 0.125 mm), and are now focused on launching the world’s thinnest 90 μm capacitors. In high-capacitance MLCCs, we are mass producing EIA 1812 size (4.5 mm × 3.2 mm) capacitors with the world’s highest capacitance at 470 μF, with the goal of bringing this the next step forward in 2016 with the start of mass production of capacitors with 1,000 μF capacitance and promoting the replacement of electrolytic capacitors with high-capacitance MLCCs.