Feature

Aiming for Accelerated Growth

in Automobile Market

In the automobile industry, a new field called "CASE" is causing a paradigm shift. Due to the progress being made with CASE, expectations are rising even in the electronic components industry that the automobile market will become a new growth field. In this special feature, each of the three men who are responsible for managing sales, production, and quality assurance will explain TAIYO YUDEN's efforts in the automobile market.

Shinya Miyazawa

Operating Officer,

in charge of Marketing

Susumu Higuchi

Senior Operating Officer, in charge of Electronic Components Division 2

Toshimitsu Honda

Senior Operating Officer,

in charge of Quality Assurance

Please tell us about the current status of development in the automobile market.

A1. It is expanding at a pace that greatly exceeds market growth.

Miyazawa: The major trend in the automobile market in recent years is called CASE, an acronym that stands for Connected, Autonomous, Shared, Electric. Electrification is progressing due to xEVs*, and the increase in the number of electronic components installed per completed vehicle is gathering pace. In accordance with use of electronic control equipment exemplified by advanced driver assistance systems (ADAS), the greater use of electronics in automobiles has been spurred, and the installation ratio of semiconductors and sensors has increased significantly. Demand for multilayer ceramic capacitors (MLCCs) and inductors, which are indispensable for these stable operations, is showing growth that is outstripping the number of automobiles produced.

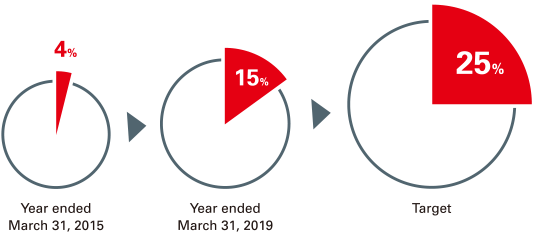

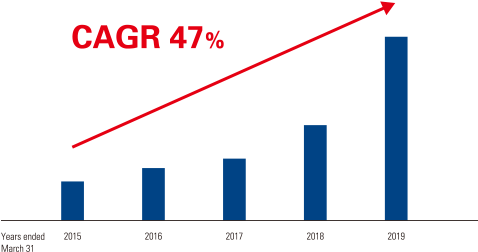

Under these circumstances, the TAIYO YUDEN Group net sales of electronic components for automobiles expanded at an average annual growth rate of 47% from the fiscal year ended March 31, 2015, to the fiscal year ended March 31, 2019, a pace that far exceeded market growth. Following the subsidiary acquisition of and contribution from ELNA CO., LTD., whose mainstay products are aluminum electrolytic capacitors for automobiles, in the fiscal year ended March 31, 2019, the sales composition ratio of electronic components for the automobile market reached the initial target of 15%.

*General term of BEV (battery electric vehicle [EV]), HEV (hybrid EV), PHEV (plug-in hybrid EV), FCEV (fuel cell EV)

■Trends in Sales to Automobile Market

What were the contributory factors in the expansion of transactions in the automobile industry with its high barriers to entry?

A2. They were our highly rated product design based on advanced material development technologies, and stable supply capabilities.

Miyazawa: It was 2011 when TAIYO YUDEN decided to enter the automobile market in earnest. Having established a dedicated organization, we started approaching Tier 1 manufacturers*. As a manufacturer coming late onto the scene, it was not easy for us to break into the automobile market, an industry in which results are everything as quality and stable supply are more important than anything else.

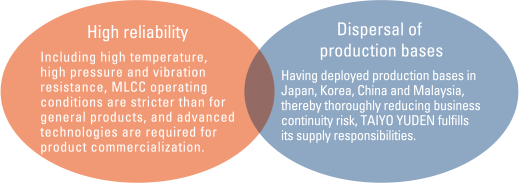

Under such circumstances, the most important factors that enabled us to expand business transactions with Tier 1 manufacturers have been our excellent technologies and product appeal we have developed since our foundation, which have created the most advanced products. Indispensable in electronic circuits, MLCCs in particular have become a major strength because they were developed in-house from materials that control circuit performance. The Company has also been highly evaluated for having deployed production bases in four countries—Japan, China, Korea and Malaysia— and for having built a robust global stable supply system with a disaster risk-resilient BCP.

There being growing needs for higher functionality, improved safety, and energy saving in automobiles, the Company benefitted greatly from the necessity for electronic control in every component, and we were assessed that we are a supplier who can fulfill our responsibilities in supplying highly reliable products.

*Tier 1 manufacturers: Primary suppliers in a position to deliver directly to automakers.

■TAIYO YUDEN's MLCC Strengths in Automobile Market

What are the challenges for sustainable growth in the automobile market?

A3. They are zero defects and strict production control.

Higuchi: In the years to come, there will be two major challenges to further increase in sales in the automobile market. They are production control and quality assurance. To ensure thorough production control, we manufacture automobile products on dedicated lines that meet certain standards.

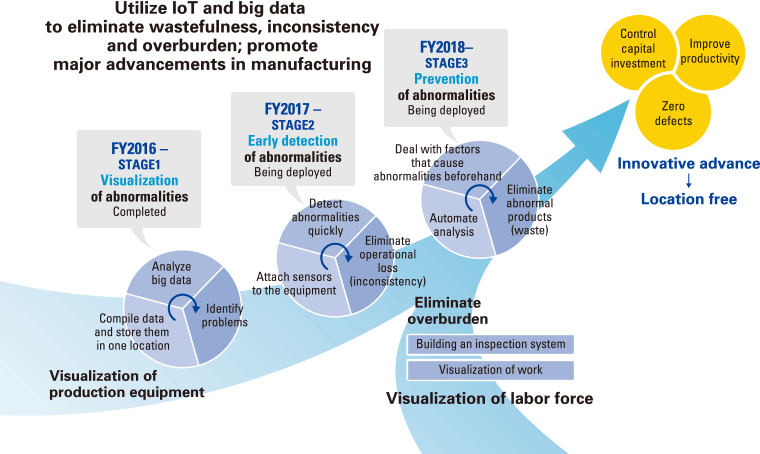

Our clean rooms are operated at a high level equivalent to that of pharmaceutical companies and semiconductor manufacturers, and we are working on the thorough removal of dust and other foreign bodies using special lasers and lights. By utilizing IoT, AI and big data, we can visualize not only the equipment but also the work status of the people in each process to improve the accuracy of early detection and the prevention of equipment abnormalities. We are also promoting the smart.E Project, production innovation activities that reduce inconsistencies, including those caused by human actions, while eliminating wastefulness, operational losses, and excessive burden thoroughly.

■"smart.E" Project: Advancements in manufacturing

A3. It is to develop human resources who possess the same eye for detail as those at Tier 1 manufacturers.

Honda: It is taken for granted that an automobile will not break down even if it runs for a long time under conditions of the kind found in scorching deserts, on snowy roads in the depths of winter, or on rough mountain roads. The electronic components installed in automobiles are also required to have high reliability to enable them to withstand long-term use under harsh temperature, humidity, and vibration conditions. Moreover, since "zero defect" is directly linked to automobile quality (brand power), strict control values are set in the production of electronic parts, and stable supplies of consistent quality are constantly being demanded.

To maintain a high level of quality control on the dedicated lines for automobile parts, only personnel who have been judged to have achieved a certain level of skill according to internal standards are engaged in manufacturing. In addition to paying close attention to various values in each process, working on the early detection and resolution of problems, and maintaining the stable production of products that meet the standards, we are striving for continuous improvement activities.

Moreover, we train and assign certified inspectors who are able to inspect and judge based on the same standards as Tier 1 manufacturers to maintain and improve the quality of daily production operations.

Please tell us about your medium- to long-term goals

A4. It is to aim for a sales composition ratio of 25% by increasing production capacity.

Miyazawa: Since the automobile market is currently in full-scale response to CASE, on a volume basis MLCC demand for automobiles from the fiscal year ended March 2019 to the fiscal year ending March 2023 is predicted to expand to 1.9 times the current level. Furthermore, the number of MLCCs installed is about 1,000 per state-of-the-art smartphone, whereas it is considered to be more than 10,000 for an electric vehicle, which is an incomparable volume of usage.

Higuchi: Under such circumstances, demand for MLCCs is expected to expand in the long term for automobiles as well as for smartphones and information infrastructure, such as base station communication devices and data centers that are compatible with the next-generation communication standard 5G era. We are investing approximately ¥15.0 billion in production subsidiary NIIGATA TAIYO YUDEN CO., LTD., where Building No. 4 (scheduled for completion in April 2020) will expand our production capacity.

Honda: While expanding our production capacity, we will face the challenges presented by zero defects for products other than MLCCs and dramatically improve productivity by means of the smart.E Project. At the same time, by expanding our lineup of products that are compatible with AEC-Q200* in a timely manner, we plan to increase the sales composition of automobile electronic components to 25%.

*AEC-Q200: Testing standard for reliability in passive onboard components (capacitors, inductors, etc.)

■Sales Composition Ratio of Electronic Components for Automobiles