Message from the President

We will balance the creation of social value with the TAIYO YUDEN Group's sustainable growth by meeting and exceeding customer expectations.

Shoichi Tosaka

President and Chief Executive Officer

The TAIYO YUDEN Group's Future Vision

Since its commercialization of the Rutilcon, barium titanate porcelain capacitors in 1950, TAIYO YUDEN has developed, produced and supplied electronic components used in various electronic devices from transistor radios used in earlier times to devices used in today's market, such as televisions, game machines, mobile phones, tablet devices and most recently, automobiles. The Company's electronic components, especially its capacitors, are essential to the manufacture of electronic equipment, including smartphones and PCs, which are viewed by many to be necessities of modern society. These components are also becoming increasingly important in the computerization and electrification of automobiles, which there continues to be growing demand. In addition, we produce critical components in support of the imminent emergence of an AI and IoT society.

TAIYO YUDEN's presence continuing to underpin the greater use of electronics around the world now and in the years to come, the Group will continue to supply high-quality electronic components (smart products) that meet and/or exceed customer expectations. As we more forward in this markets, TAIYO YUDEN will continue to face the challenges in fulfilling its management vision, "to be an excellent company that enjoys the trust and highest regard from its customers," by providing a stable supply of high-tech products in large quantities on a global basis. Our intention is to balance the creation of social value with the Group's sustainable growth by meeting market demands, while helping to build an affluent society throughout the world. To do this we will be poised to take on the technology and supply challenges this will bring.

Business Environment Surrounding the TAIYO YUDEN Group

TAIYO YUDEN is paying close attention to developments and the future direction of the global political economy, such as the trade dispute between the United States and China. In addition, the spread of next-generation 5G communication standard and the changes in the market structure due to the incorporation of unprecedented technologies, such as CASE* in the automobile industry, have had a great impact on the electronic components industry where TAIYO YUDEN operates.

We see key structural changes such as the IoT evolution on the horizon. IoT is expected to become more widespread in the years to come. At some point in the future we assume that all devices will be connected to a network. Today, we support various devices that are network-connected, starting with the automotive field, where autonomous driving is under development. Also, in the field of industrial equipment, such as security cameras and smart factories, and in the medical and healthcare fields, where remote diagnosis is expected. As a result, demand for electronic components is expected to show explosive growth. In addition, the amount of data handled by data center servers that accumulate data is expected to increase dramatically, and for that reason we are seeing increased capital investment in communications equipment for base stations, which act as data relay points.

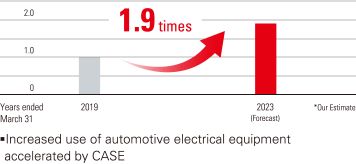

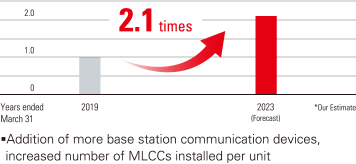

TAIYO YUDEN's main product, multilayer ceramic capacitors (MLCCs), is experiencing tremendous growth. MLCC demand to support automobiles is expected to increase by roughly 1.9 times over the next four years to the fiscal year ending March 2023. Base station communication equipment will increase by about 2.1 times over the same period. Under such circumstances, the Group is aiming for sales growth that exceeds the volume growth of the market by leveraging its strengths, such as "high reliability", "downsizing", "large capacity" and "decentralization of production bases."

*An automotive industry acronym formed from Connected, Autonomous, Shared & Services, Electric

MLCC Market for Automobiles and Information Infrastructure and Our Strengths

-

■MLCC Demand Forecast for Automobiles (Volume Based)

-

■MLCC Demand Forecast for Base Station Communications Equipment (Volume Based)

Demonstrating Our Strengths toward Sales Expansion That Outstrips Market Growth

Progress of Medium-term Management Plan and Financial Results for Fiscal Year Ended March 2019

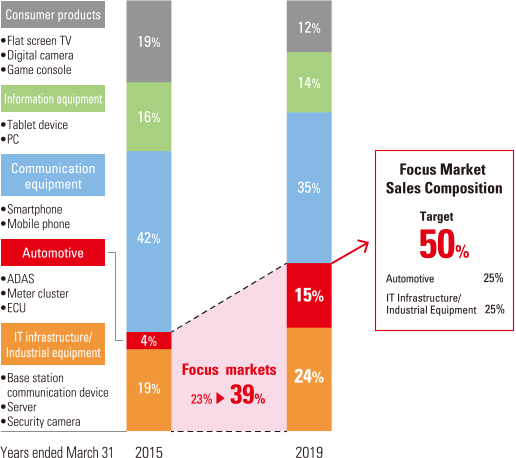

Under the Medium-term Management Plan that is currently being promoted by the Group and that will end in the fiscal year ending in March 2021, we are aiming for stable improvement in earnings, to lower the dependence on communication devices, such as smartphones that tend to have large fluctuations in demand, and to promote a business portfolio strategy that will increase the relative importance of automobiles, information infrastructure and industrial equipment. Based on this strategy, we have been working to improve our business structure, aiming for net sales of ¥300 billion, an operating margin of 10% or more, and an ROE of 10% or more.

As a result, TAIYO YUDEN's most recent financial results show consolidated sales at a record level, climbing 12.4% compared with the previous fiscal year to ¥274.3 billion in the fiscal year ended March 31, 2019. From a profit perspective, operating income jumped 74.3%, to ¥35.2 billion, and net income attributable to owners of parent company rose 44.8%, to ¥23.6 billion year on year. An important contributing factor to these results was sales of capacitors, which increased by a substantial 19.4% compared with the previous fiscal year. This was driven by business expansion and particularly strong results from the automotive, information infrastructure and industrial equipment sectors.

TAIYO YUDEN expects demand for its electronics components to again expand in the fiscal year ending March 31, 2020, primarily in the automotive, information infrastructure and industrial equipment market sectors.

In addition, the operating margin target is being achieved, which had been set at 10% in the Medium-term Management Plan, and was revised upward to 15% or more. This was mainly fueled by greater than expected growth in sales to the automotive sector. We aim to further increase earnings and achieve our Plan in the years to come with a key focus on three main measures: (1) expansion of focus markets, (2) investment for future growth, and (3) advancements in manufacturing.

Expansion of Focus Markets

Under its Medium-term Management Plan, the Group has established "focus markets," with the aim of transitioning from an earnings structure that relies on equipment with severe fluctuations in demand, and strengthened efforts in all product development, production, and marketing for those markets. The most important of the focus markets is the automotive segment, where demand for electronic components has been expanding rapidly in recent years. According to our estimates, the number of MLCCs installed per vehicle is about 3,000 for mid-class, gasoline-powered vehicles and about 7,000 for electric vehicles, and the usage per vehicle will only continue to expand in the years to come. Although the Group was a late in starting manufacturing in support of the automobile market, we entered the market at a time when demand for electronic components was increasing against the background of the evolution of safety functions and the progress being made with electric vehicles. Our sales expansion in this market continues to outpace market growth. In addition to the automobile market, our focus markets include the information infrastructure and industrial equipment fields. Our concentration in these fields is focused on base station communication equipment in the lead-up to the start of 5G services.

The initial plan was to expand sales for automobiles and industrial equipment, which had made up 23% of net sales in the fiscal year ending March 2015, to 38% by the fiscal year ending March 2021. This target was revised given 39% had been achieved in the fiscal year currently under review. In the years to come, we aim to achieve a sales composition ratio of 50% for the automotive, information infrastructure and industrial equipment markets, where growth is expected. Within this plan we are aiming to increase sales in automotive sector to 25%.

By increasing the sales composition ratio in the automobile market as well as in the information infrastructure and industrial equipment markets, we will secure a certain level of profit even in years when the external environment is adverse. This will allow the Group to transform into a corporate structure that can sustain growth. In the medium term, we plan to improve our earnings structure to become a company capable of generating operating margin of 15% on a consistent basis.

■Sales composition by market sector

Investment for Future Growth

Investment for future growth is the second measure under the Medium-term Management Plan. For this measure we will continue to undertake aggressive capital investment to respond to the rapid increase in demand, as explained above. Following the start of Building No.3 operations at the production subsidiary NIIGATA TAIYO YUDEN CO., LTD. in March 2019, construction of Building No. 4 is scheduled for completion in April 2020. These actions will further expand our production capacity. Over the three years from the fiscal year ended March 2019 to the fiscal year ending March 2021, we will make a cumulative total of ¥150 billion in capital investments.

Meanwhile, we maintained an aggressive approach toward R&D and invested approximately ¥13 billion in R&D expenses in the fiscal year ending March 2019. Recognizing that R&D is the source that drives our future, we will continue to invest a certain amount on the future in the years to come, focusing on the development of products, including capacitors, inductors and communication devices, and the creation of new business through solution proposals.

Through these capital and R&D investments for future growth, we will steadily advance preparations for the leap forward from fiscal 2020 onward, when the IoT era is set to begin in earnest.

-

■Capital investment

-

■R&D expenses

Advancements in Manufacturing

TAIYO YUDEN is now in the fourth year of its smart.E Project that began in 2016. This project is designed to "promote advancements in manufacturing," an initiative under the Company's Medium-term Management Plan. Under this project, we are working to improve yields by eliminating inconsistencies in equipment and personnel. At the same time, we are uncovering the reasons for faults and malfunctions to as far as possible prevent them from occurring while aiming to create a production system capable of efficiently handling mass production to an unprecedented degree.

By the end of the fiscal year ended March 2019, the smart.E Project initiative was utilizing AI technology and had proven effective in the early detection and prevention of abnormalities, suppression of quality variations, improvement of yield, and improvement of human productivity. In locally measured cases, improvements in productivity of around 30%-40% had been realized, and we will continue to promote activities.

The smart.E project has been promoted mainly in Japan and will be expanded to overseas factories in the years to come. Ultimately, we are aiming to build a location-free, borderless production system that will maintain the same quality and productivity regardless of the plant's location. Through the evolution of manufacturing, our policy is to minimize wastefulness and improve productivity by an order of magnitude, while at the same time improving production capacity.

ESG Strategies

First of all, we believe it important to solve social issues through our business activities. For that reason, we would like to realize our management vision through the development and provision of smart products* while contributing to the creation of a prosperous society and the resolution of social issues.

As evidenced by the adoption of the Sustainable Development Goals (SDGs) at the United Nations, in global society there are mounting expectations being placed on the corporate sector with regard to the solving of social issues. At the same time, there are growing demands from society, such as environmental, social, and governance (ESG)-based investment by investors—for companies. Companies are expected to engage in sustainable corporate activities that place emphasis on ESG concerns. As a result, TAIYO YUDEN is working to share throughout the Company future business opportunities and risks that touch on ESG concerns while addressing specified issues.

For example, we are endeavoring to contribute to the environment through our product strategy. Our group is keenly aware that climate change will have a massive impact on the future of our planet. We understand our responsibility to important environmental issues and we are making efforts to reduce CO2 emissions and energy consumption across our manufacturing processes, by promoting smart processes such as "minimizing emissions" and "more efficient use of energy," in a bid to help realize a zero carbon society.

With regard to the social aspects of our business operations, as a company that undertakes business activities on a global basis, we pay the utmost respect to the rights of all individuals in the conduct of our business activities worldwide. We see the continuance and further development of these efforts as an issue of the utmost importance.

As far as governance is concerned, having objectively analyzed any discrepancies between the current status of governance within the Company and the ideal scenario, we are taking the necessary steps to fill any gaps. As one such step, we are ensuring objectivity and transparency in the processes involved in the nomination of director candidates and evaluations of officers as well as in determining remuneration by having the separate nomination and remuneration committees chaired by an independent outside director and their members made up of the president, outside directors and auditors.

*Smart products: Highly reliable and safe products that are energy efficient and do not employ hazardous materials.

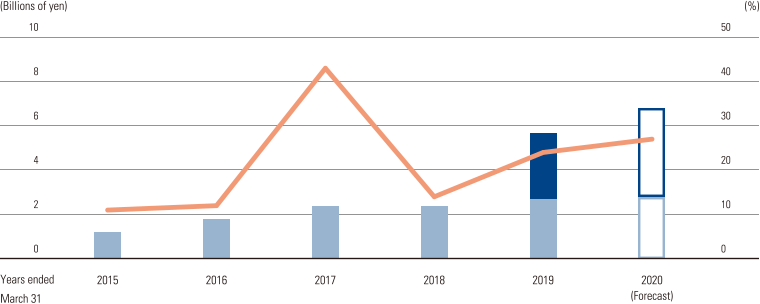

Returning Profits to Shareholders

The return of profits to shareholders is one of its most important management issues for the Company. We continue to focus our efforts toward stable increases in dividends while targeting a total return ratio of 30%, including the acquisition of treasury stock. In the fiscal year ended March 31, 2019, the year-end dividend per share was increased by ¥1, making a total of ¥21 when combined with the interim dividend. In addition, as a result of the acquisition of approximately ¥3.0 billion of treasury stock during the fiscal year for the purpose of improving capital efficiency, the total return ratio was 24%. In the fiscal year ending March 31, 2020, we will acquire approximately ¥4.0 billion of treasury stock and plan to increase the dividend by ¥1.

At present, we believe this to be an important time for investment for future growth, targeting the increase in demand for electronic components associated with advance of the IoT society. We aim to achieve stable shareholder returns in line with the target level. This is dependent on improvements in our cash position brought about, for example, by growth in our focus markets.

■Return to shareholders