President's Message

President Interview

Smartphones continue to show increased sophistication and functionality, and the number of devices included in each unit also continues to show a sharp rise. Moreover, IoT, which involves the connection of almost everything to the Internet, is beginning to spread to a wide variety of fields. The automobile industry is not only developing electric vehicles, but also advancing the realization of autonomous driving systems. This trend has contributed to an increase in the number of electronic components required for each vehicle. Given these developments, we expect a sharp increase in demand for electronic components from 2020 and on.

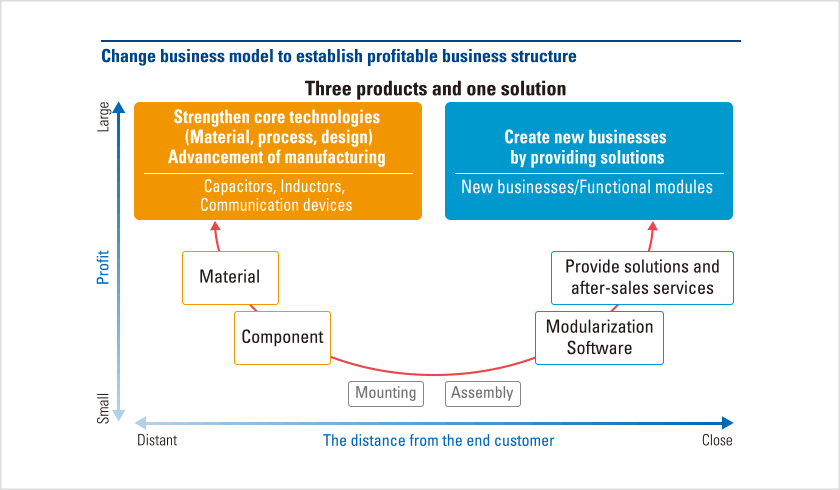

TAIYO YUDEN offers three core tangible products: capacitors, inductors, and communication devices. This group of products can be seen on the left side of the smile curve (shown below), which illustrates added value in manufacturing.

This is our core business in which growth can be expected, and is centered on smartphones, so we remain focused on developing the most cutting-edge products in this area. At the same time, we are targeting “an expansion in focus markets” including automotive and industrial equipment sectors, which constitute a stable earnings base for TAIYO YUDEN.

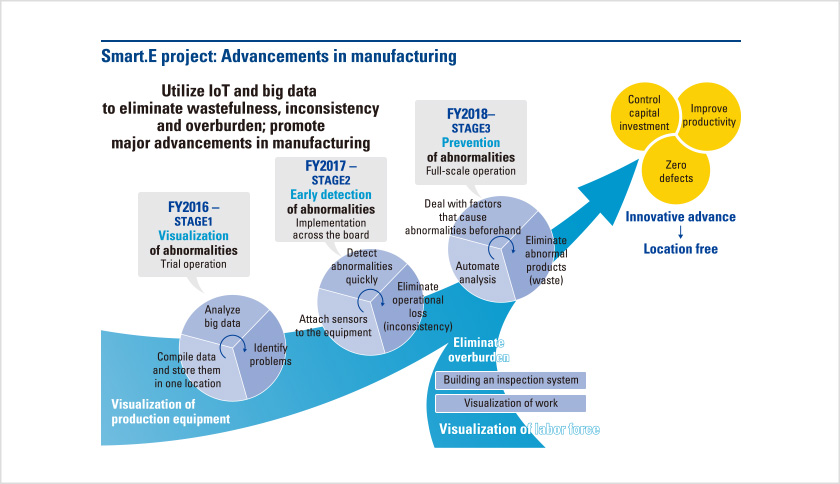

We are also moving forward with the “smart.E” project to further evolve our manufacturing capabilities so that we can successfully respond to greatly increased demand for electronic components and further reduce costs.

The right-hand side of the smile curve shows that we are focused not only on the supply of modules, but also the “creation of new businesses,” with a clear emphasis on providing solutions (a service as opposed to the three core tangible products mentioned previously).

On the back of these efforts, we are aiming at sales of ¥300 billion, an operating income margin of at least 10%, and ROE of at least 10% as our medium-term target.

As for the first initiative of “an expansion in focus markets,” we are aiming at increasing the sales composition ratio of automotive and industrial equipment sectors, whose demands are expected to be high and stable in future, from 24% at present to 38%. We note that average annual growth over the past five years for automotive-related sales has been 34%, thanks to a stable supply system and an enhanced product lineup. We estimate the automotive electronic component market will expand sharply from about ¥19 trillion in 2015 to about ¥32 trillion in 2025. We expect to increase automotive sales at a pace exceeding that for the market as a whole, and aim to boost our sales ratio for automotive electronic components from 6% at present to 15% over the medium term.

The second initiative is the “evolution of manufacturing capabilities.” In this sector we are working on the smart.E project. This involves “visualizing production facilities” through the introduction of common-use systems 16 years ago and the real-time computerization of operating conditions at various production facilities. Alongside an expansion in scope, the smart.E project targets visualization of the labor force, and further synchronization between employees and production equipment to innovatively bolster productivity. Our goal is to improve productivity to a new level through the elimination of wastefulness, inconsistency and overburdening.

In the past, systems were optimized on an individual basis at varying production sites, with integration only coming afterward. However, this method of linking the skills of various individuals is not suitable in a business where sales exceed ¥300 billion. It is therefore our goal to greatly evolve TAIYO YUDEN’s manufacturing capabilities before the surge in demand brought on by advancements in electrification truly arrives.

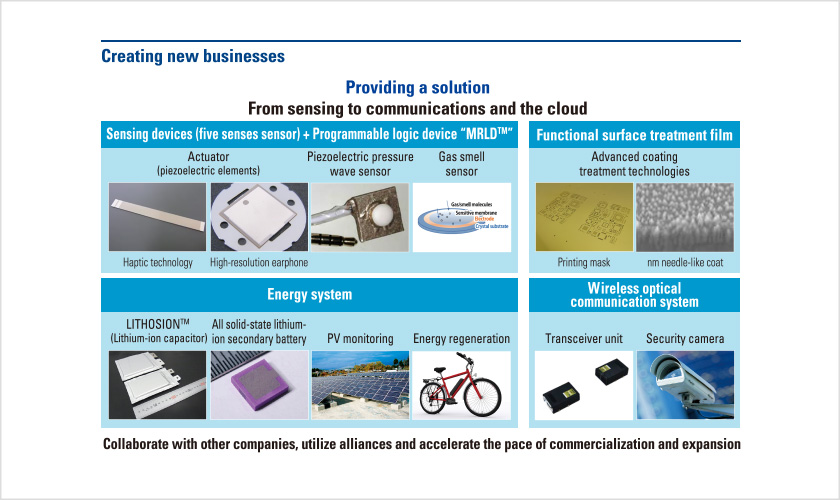

We are working to create and provide new services for the core businesses that supply mainstay products such as capacitors, inductors and communication devices, and through these new services we are focusing on providing high-value added solutions to our customers. In sensing devices, our goal is the creation of a business offering total solutions, including after-sale services that include verification of how the information was processed based on what means of communication was used and what was sensed and how.

The results of our efforts are already beginning to materialize. We could establish a business model, expanded sales, and commercialized the energy regeneration system for electric bicycles that we had been targeting as a new business for some time. An example of a project currently under development is the next-generation wireless optical communication system.

As the management of security becomes increasingly sophisticated, demand for security cameras is expanding. TAIYO YUDEN can provide solutions in a number of related areas, including underwater communication and the building of wireless networks that are safer and can be placed in previously unreachable locations. We are also working on making “odor sensors” that differentiate various gasses smaller and more sensitive in order to accelerate commercialization. In addition, we see a number of promising applications in haptic technology, which allows the feeling of contact through a touch panel.

Our tangible products have allowed us to expand our business with customers in existing fields and refine our technology and know-how. By promoting new businesses, we aim to strengthen our approach to new customers, mainly in different industries, and create a completely new type of business. We will actively consider collaboration and alliances with other companies as we seek to accelerate the creation of new businesses.

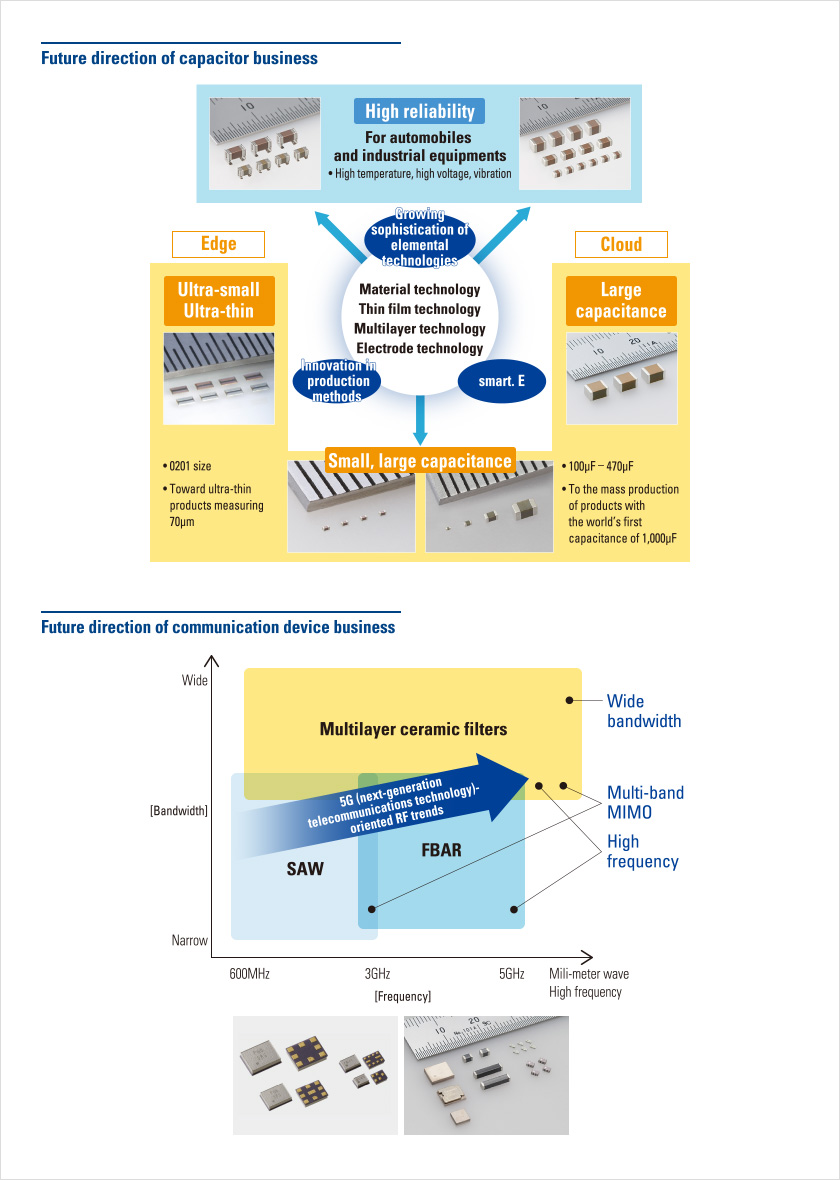

Our product strategies are based on the quality and functional requirements of our customers. We are focusing our efforts in the smartphone market, which demands ultra-small, ultra-thin, and large capacity capacitors, and the automotive and industrial equipment markets, which require high capacity and highly reliable (able to withstand high temperatures, high voltage and strong vibrations) capacitors. TAIYO YUDEN continues to lead the industry in increasing capacity, and we expect to launch mass production of the world’s first multilayer ceramic capacitor (MLCC) with capacitance of 1,000μF in the fiscal year ending in March 2018. Capacity of 1,000μF would allow greater reliability in frequency response from electrolytic capacitors and could further advance the shift to MLCCs.

Inductors are required for greater currents and we are expanding our lineup of highly reliable products in this area while also working to expand our sales channels to the automotive sector. In the fiscal year ended in March 2017, we were able to successfully commercialize inductors able to withstand temperatures of 150°c and a vibration resistance of 30G. This product can be used in electronics housed in an engine room with high temperatures and strong vibrations. It also conforms to the AEC-Q200 global reliability standard for electronic components used in automotive applications. We are steadily expanding our lineup of inductors for automotive applications while at the same time targeting an expansion in supply.

Backed by our development and production technologies in SAW, FBAR and multilayer ceramic filters, our strength in communication devices lies in our ability to offer one-stop solutions in a wide range of increasingly sophisticated communications-related functions, including in regards to the increased use of multi-band and higher frequencies. We are preparing for the future launch of 5G (fifth generation mobile communications) services over the next few years by focusing our energies on the development of one-of-a-kind products based on a combination of these three technologies.

For the fiscal year ending in March 2018, we are forecasting an expansion in cutting-edge products for communication devices such as smartphones, where increased sophistication and functionality continues to advance quickly. And, highly reliable products for the automotive and industrial equipment sectors will grow strongly amid an ongoing shift to electrification. We forecast consolidated sales reaching a record ¥242 billion (up 4.9% from the previous year). Thanks to an expansion in high value added products and a reduction in costs, we expect operating income to reach ¥15 billion (up 21.1%) and net income attributable to owners of parent company to reach ¥9.0 billion (up 65.8%).

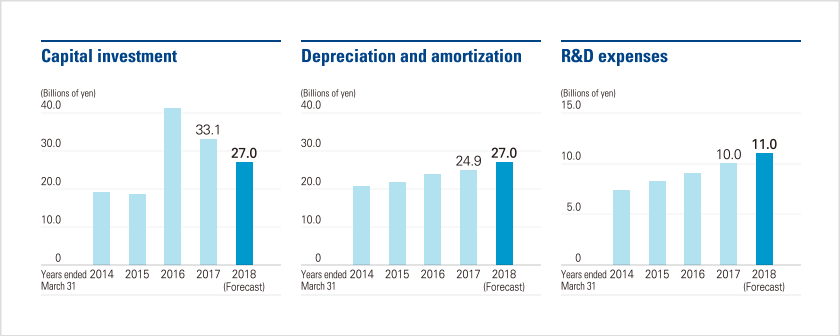

We target capital investment of ¥27 billion. Combined with the two previous years, we are investing about ¥100 billion, and we expect to keep up this pace in the years ahead. We have earmarked ¥11.0 billion for R&D expenses to accelerate development of new technologies and products, up ¥1.0 billion from last year.

With regard to returning profits to shareholders, our medium-term business plan targets a total return ratio, including repurchased shares of 30%, while maintaining a stable and sustainable earnings structure and an improved financial structure, including positive net cash. For the fiscal year ending in March 2018, we target a stable dividend of ¥20 per share, with a dividend payout ratio of 26.2%.

This website contains forward-looking statements. These forward-looking statements are not guarantees of future performance, and they involve inherent risks and uncertainties.

A variety of factors including changes in the business environment could cause actual results to differ materially from those in the forward-looking statements.