Message from the President

Continue Sustainable Growth-oriented Management while Closely Watching the Impact of COVID-19

Shoichi Tosaka

President and Chief Executive Officer

The TAIYO YUDEN Group's Future Vision

Support to the Electronics Industry through Smart Products

Since its inception in 1950, TAIYO YUDEN has been supplying capacitors and other electronic components that have been critical to the evolution of everyday electronic devices. We have consistently used internally developed materials as the bases of our products to assure top performance of the electronic components we make. In recent years, various industries have used an increasing number of electronic components as the need for compact/high-performance devices is rising. Accordingly, the TAIYO YUDEN Group is focused more than ever before on its signature credo of "conducting every step from the research and development of materials to product commercialization." This is our major driver to grow business.

Against this backdrop, the TAIYO YUDEN Group aims to solve social issues in the electronics field and contribute to the creation of a safe, comfortable, and convenient society by realizing its vision "to be an excellent company that enjoys the trust and highest regard from its customers" through the development and provision of "smart products."

Financial Results for the Fiscal Year Ended March 2020

Reached Record-high Net Sales and Operating Income

Consolidated net sales for the fiscal year ended March 31, 2020 totaled ¥282.3 billion, which is an increase of 2.9% compared to the corresponding period of the previous fiscal year, and operating income rose 5.5% to ¥37.1 billion, for new record highs. The core capacitor business growth was driven by automotive applications where the number of electronic components installed per vehicle has risen with the increased use of electronic equipment. In addition, net income attributable to owners of parent company was ¥18 billion, down 23.9% year on year. This was the result of recording extraordinary loss that included impairment loss on goodwill associated with ELNA CO., LTD., our subsidiary, and loss on disaster related to our subsidiary FUKUSHIMA TAIYO YUDEN CO., LTD., which incurred typhoon-related damage.

Impact of COVID-19

Operations Back to Normal but Watching Future Impacts

The TAIYO YUDEN Group has been impacted by the rapid spread of COVID-19 in 2020. We limited operations at our production facilities in the Philippines and Malaysia at one point from March in accordance with governments' restrictions on activities and movement. In addition, we were affected mainly by increases in logistics costs and lead-times due to a reduction in flights. In response, the TAIYO YUDEN Group implemented various measures that included activating its Business Continuity Planning (BCP) measures, taking steps to prevent further infections, changing distribution channels, and securing alternate transportation routes. Currently*, operations at production facilities have normalized and business activities are running as usual. Nevertheless, we will remain vigilant as supply chains could be disrupted again in the event of another wave of infections.

*As of August 2020

Future Business Conditions & Earnings Forecasts

Electronic Components are a Medium- to Long-term Growth Market

In the fiscal year ended March 31, 2020, the impact of COVID-19 on earnings was minor. However, the near-term impact on the TAIYO YUDEN Group's earnings has become a greater concern mainly attributed to the noticeable reduction in automobile production with the global economy clearly slowing. In addition, business conditions are currently unclear due to worsening trade friction between the United States and China. The TAIYO YUDEN Group targets net sales of ¥300 billion, operating margin of 15%, and ROE of over 10% for the fiscal year ending March 31, 2021, the final year of the medium-term management plan. However, we now expect to achieve these targets from the next fiscal year due to temporary stagnation caused by COVID-19.

Despite this situation, accelerating demand growth for electronic components is a medium- to longterm trend that remains unchanged and is being driven by the shift to 5G next-generation communication standards and development of CASE* in the automobile market. Particularly in 5G, China has already taken the lead in revitalizing these markets. The 5G market is expected to undergo full-scale growth worldwide owing to the switch to 5G-compatible smartphones along with upgrading telecommunication base stations and other infrastructure.

With the start of 5G services, there will certainly be an increase in the number of electronic components installed not only in smartphones but also various types of electronic machinery. It is easy to guess that the need for high-end components will pick up as the load on devices will increase when 5G software services improve. As a result, we think the need for high-end components like capacitors supplied by the TAIYO YUDEN Group will continue to increase significantly. Beyond capacitors, we also see products like inductors and communication devices moving in the same direction.

While negatives from COVID-19 look unavoidable in the short term, we expect the TAIYO YUDEN Group's medium- to long-term growth potential to steadily increase.

* An automotive industry acronym formed from Connected, Autonomous, Shared & Services, Electric

Core Product Strategies

Enhance Products & Lineups

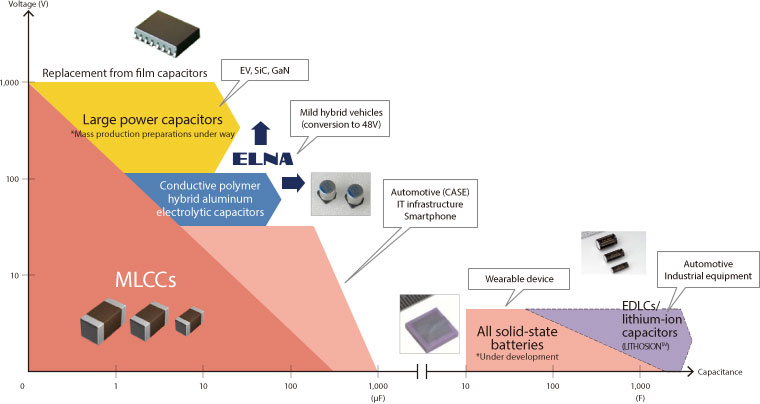

As for product strategies, we are continuing to evolve our core multilayer ceramic capacitor in terms of smaller sizes and larger capacitance. At the same time, we intend to capture demand for power-assist hybrid vehicles with our offering of our hybrid aluminum electrolytic capacitors made by our subsidiary ELNA CO., LTD. which cover the high voltage zone requirements. Moreover, we will expand electric double-layer capacitors and lithium ion capacitors in the farad-unit high capacity zone.

As for ferrite and applied products, inquiries have picked up regarding our unique multilayer power inductors that use metal materials. This compact product demonstrates extremely high performance in large currents while leveraging its cost advantages through the TAIYO YUDEN multilayer technology. This makes our products very competitive for 5G smartphones. Not relying on the smartphone market, however, we will install our new inductor products into automotive, IT infrastructure, and industrial equipment based on two key types: compact multilayer and large coil-wound.

As for communication devices, higher volumes for multilayer ceramic filters look promising along with increased demand for SAW and FBAR filters for 5G smartphones. We will therefore pursue development of new ultra-small/low-profile products that conform to these design requirements. In addition, TAIYO YUDEN Group filters command a high market share for telematics and other applications owing to their reliability. Going forward, we aim to further expand automotive applications for these filters.

■Capacitor Business Direction and Positioning of ELNA CO., LTD.

Expansion of Focus Markets

Sales Growth in Focus Markets where Demand is Stable

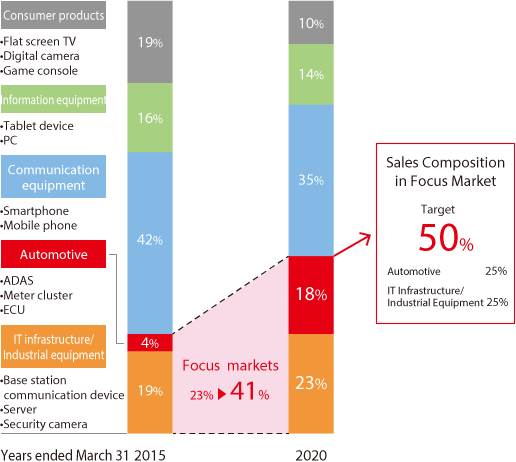

As a key strategy of the medium-term management plan, the TAIYO YUDEN Group has intensified its efforts in all areas of product development, production, and marketing, targeting focus markets in order to reduce its dependence on smartphones and other devices subject to sharp demand swings. Accordingly, we targeted a rise in sales composition ratio to 38% for automobiles, IT infrastructure, and industrial equipment by the fiscal year ending March 31, 2021. We subsequently reached this target two years earlier than planned in the fiscal year ended March 31, 2019 owing to brisk sales growth in focus markets. Further to this achievement we raised the sales composite target for this segment to 50% and we are continuing our marketing activities to this end.

Expectations are extremely high for the TAIYO YUDEN Group given the limited number of suppliers able to steadily supply large volumes of high-quality electronic components that are required to have a high level of reliability for use in automobiles, IT infrastructure, and industrial equipment. The sales composition ratio in the fiscal year ended March 31, 2020 was 18% for the automotive and 23% for IT infrastructure and industrial equipment markets, for a combined total of 41%. Our efforts to steadily penetrate growth markets to capture stable demand has started to bear fruit. In focus markets, we intend to extend our targets to include medical devices and robots in the industrial equipment field.

■Sales Composition by Market Sector

New Businesses

Taking on the Challenge of New Businesses with Innovative Solutions

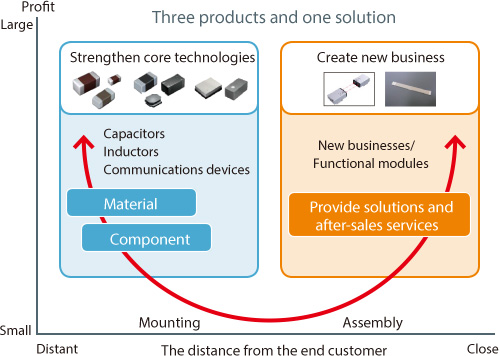

The TAIYO YUDEN Group is developing new businesses in order to expand its earnings source. To this end, we will fully committed to develop electronic components that leverage our strengths in areas such as material and multilayer technologies while also working to enhance the provision of high-value-added solutions at the right edge of the smiling curve.

For example, the development of actuators using piezoelectric materials for use in automobile touch panels involves offering solutions for tactile technology that combines both tangible and intangible aspects.

In addition, we completed a prototype for an all solid-state battery and plan to start shipping samples in the fiscal year ending March 2021. We expect demand for replacing conventional batteries with all solid-state batteries to emerge mainly for wearable devices based on the safety features of solid-state batteries, (i.e. there is no combustion or leakage) and TAIYO YUDEN's miniaturization expertise.

■Business Model Change for Establishing a Profitable Operating Structure

Advancements in Manufacturing

Steadily Improving Production Efficiency via the smart.E Project

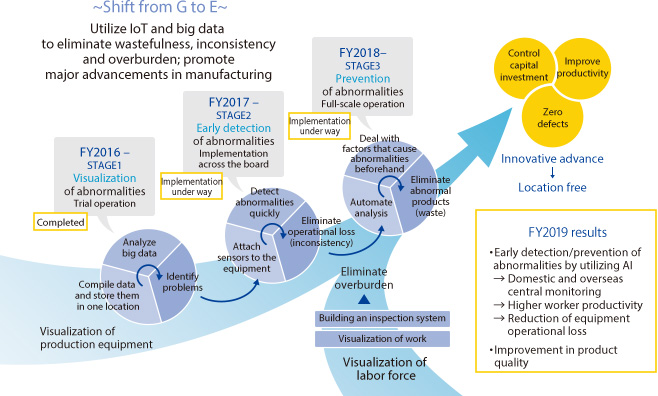

We have been implementing the "smart.E" project since its inception in 2016 under the banner: "advancement of manufacturing." The smart.E project creates mechanisms for efficiently producing electronic components addressing the demand increases by eliminating equipment and human variances to increase yields while preventing malfunctions and defects. In the fiscal year ended March 31, 2020, by using AI to constantly watch for production abnormalities the TAIYO YUDEN Group is able to unitarily monitor operations in Japan and overseas. This drives better human productivity, and a reduction in facility operational loss. TAIYO YUDEN's smart.E has not only realized visibility of equipment status but also identified skill difference among plant employees, resulting in higher product yields and quality.

Going forward, we plan to build a location-free framework that enables identical manufacturing at any plant around the world. The TAIYO YUDEN Group has dispersed its production globally centered on capacitors and inductors, but functions currently vary by region as does what can and cannot be done. Transitioning to borderless production will be our challenge in the years ahead. In light of this, we will accelerate our efforts to develop a flexible global production system that enables us to quickly pivot to other locations when production facilities anywhere are stopped due to such threats as pandemics like COVID-19 or natural disasters. Furthermore, we plan to proactively automate production to a greater extent than before through robotics and mechanization.

■"smart.E" Project: Evolution in the Manufacturing Process

Investment for Future Growth

Continuing Growth Investment to Meet Higher Demand over the Medium to Long Term

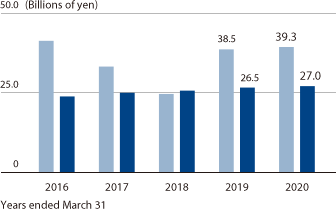

We recognize this is a critical time to undertake investment aimed at electronic component demand growth over the medium to long term. For multilayer ceramic capacitors, we have enhanced production capacity by 10-15% year on year in the fiscal year ended March 31, 2020. In April 2020, we have completed construction of Building No. 4 for our production subsidiary NIIGATA TAIYO YUDEN CO., LTD. We plan to continue these investments and further enhance production capacity on an ongoing basis.

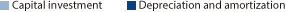

We are also concentrating our efforts on R&D, from which the TAIYO YUDEN Group's future is forged. To this end, we will aggressively invest in core product development as well as new business creation.

-

■Capital Investment/Depreciation and Amortization

-

■R&D Expenses

ESG Strategies

Establishes the Sustainability Promotion Department and signs the United Nations Global Compact

The TAIYO YUDEN Group is enhancing initiatives in ESG (environment, social and governance) by continuing our focus on sustainable corporate activities. Each TAIYO YUDEN employee on a worldwide bases is expected to fully adhered to our CSR Code of Conduct and has undertaken activities that more proactively realize their social responsibilities. We recently established the Sustainability Promotion Department in order to further promote these activities companywide while taking steps to enhance ESG and SDGs (the Sustainable Development Goals) related activities and information disclosure. In addition, TAIYO YUDEN became a signatory to the United Nations Global Compact (UNGC) and joined the Global Compact Network Japan. We strongly support the UNGC's 10 Principles categorized into the four areas— "Human Rights," "Labour," "Environment," and "Anti-Corruption."

In the fiscal year ended March 31, 2020, we began measuring river water levels on a trial basis to make a contribution in the environment/climate change field. And the TAIYO YUDEN Group will more aggressively work to solve social problems and create an affluent society through the development and provision of smart products going forward.

As for corporate governance, we are discussing ways to improve corporate value over the long term led by the Board of Directors. We are aware that the development of future generations of a management group is one of our important responsibilities. Executive directors who are candidates to be future Board of Director members are being trained with the objective to improve qualifications. The training involves job rotations on an as-needed basis and providing a diverse array of experience that includes practicing goal management using key management indicators. We regularly conduct training for directors and executive officers based on timely themes and case studies, while working to improve executive knowledge and skills. I personally intend to build a management structure that can achieve long-term growth.

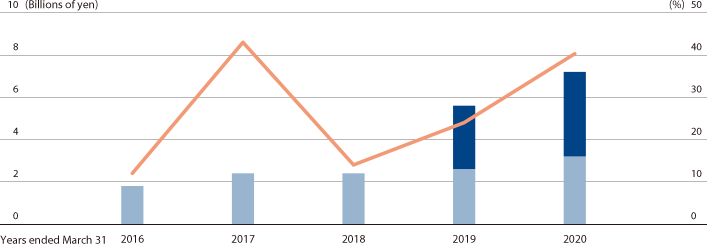

Shareholder Returns & Financial Strategy

Aim for Stable Returns while Preparing for Unforeseen Contingencies

Finally, I would like to discuss returning profits to our shareholders. TAIYO YUDEN targets a total return ratio of 30%, which includes share buybacks, as part of our policy to increase dividends on a sustainable basis. We raised dividends for the fiscal year ended March 31, 2020 by ¥5 year on year to ¥26 per share. In addition, we implemented buybacks of around ¥4 billion aimed at improving capital efficiency, resulting in total return ratio of 40%.

As for our financial strategies going forward, we will maintain a stable financial base, keeping equity ratio at around 60%, as well as make absolutely sure that we are prepared for unforeseen contingencies, which includes signing commitment lines totaling ¥30 billion with multiple financial institutions.

■Returning Profits to Shareholders