- Policy to determine the contents of remuneration paid to each Director

- Total remuneration for each officer category

- Remuneration Committee

Policy to determine the contents of remuneration paid to each Director

1. Basic policy

The remuneration plans for directors (and other officers) of the Company shall be designed to raise motivation for the achievement of the goals for the economic value and social value of the Medium-term Management Plan in accordance with the following basic principles.

-

1.Remuneration plans shall emphasize the linkage with remuneration and the Group's sustainable growth and medium- to long-term corporate value, and be designed to share the same value with shareholders.

-

2.Remuneration shall be set at levels that can attract and retain excellent human resources with global perspective.

-

3.The process to determine remuneration shall be highly transparent and objective.

2. How to determine remuneration levels

Remuneration levels shall be determined by selecting a group of benchmark companies using objective remuneration for directors (and other officers) survey data provided by external expert organizations in order to ensure that they are sufficient to motivate the achievement of the goals of the Medium-term Management Plan and to enable the Company to secure excellent human resources.

3. Remuneration structure by position

-

1.Executive Directors

"Basic remuneration," "performance-based bonuses" as incentive for the execution of business, and "stock remuneration" will be paid with the objective of encouraging management that emphasizes the continuing improvement of corporate value. -

2.Non-executive Directors who are not Audit & Supervisory Committee Members

In consideration of their position as independent from the execution of business, only basic remuneration will be paid. -

3.Directors who are Audit & Supervisory Committee Members

In consideration of their position as independent from the execution of business, only basic remuneration will be paid.

4. Composition of remuneration

| Type of remuneration | Content, etc. of remuneration | Fixed / Variable | |

|---|---|---|---|

| Basic remuneration | Monthly cash in accordance with position and responsibilities | Fixed | |

| Performance-based bonus | Cash to be paid at a fixed time each year in accordance with the consolidated performance for each

fiscal year. Consolidated profit will be used as the relevant performance indicator to establish a

clearer linkage between remuneration and factors contributing to the enhancement of corporate value

and shareholder value. The standard amount of remuneration shall be designed to fluctuate based on the consolidated profit for the fiscal year under review in a manner that the ratio of basic remuneration to performance-based bonus is 1:1 when the goal of the Medium-term Management Plan is achieved. The actual amount to be paid shall be determined by multiplying the standard amount to be paid by the co-efficient (75% to 125%) as calculated from the level of performance of the business the applicable officer is in charge of, the level of achievement of the social value goal in the Medium-term Management Plan, and individual evaluation. |

Variable | |

| Stock remuneration | Restricted stock remuneration by position | On the condition of continuous service for the period set by the Company's Board of Directors, restricted stock will be issued in advance at a certain time each year in accordance with the standard amount set for each position. The restrictions shall be released upon the forfeiture of all and any positions as Director and Operating Officer of the Company. |

Fixed |

| Performance-based post-delivery restricted stock remuneration | Restricted stock as calculated in accordance with the level of achievement of the return on equity (ROE) in the Medium-term Management Plan will be issued at the end of each fiscal year. The amount will vary within the range of 0% to 300% against the standard amount for each position, based on the level of achievement of consolidated ROE. The restrictions shall be released upon the forfeiture of all and any positions as Director and Operating Officer of the Company. | Variable | |

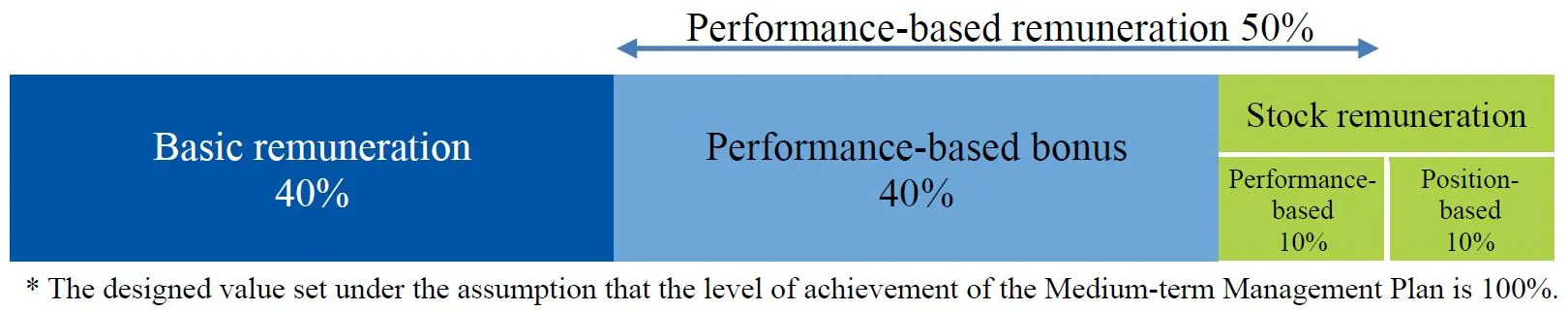

Composition of remuneration for Executive Directors (as per design)

5. Process to determine remuneration

In order to ensure the transparency, objectivity and fairness of the process to determine remuneration for directors (and other officers), the Remuneration Committee, which is an advisory panel to the Board of Directors, deliberates and reports on matters pertaining to remuneration for Officers such as basic remuneration policy, plans, calculation methods, and specific remuneration content of individual Officers.

Within the limit of remuneration resolved at the General Meeting of Shareholders, specific remuneration of Directors is deliberated on an individual basis by the Remuneration Committee based on the amounts of remuneration calculated based on the relevant rules and regulations established by the Company and are determined by the Board of Directors based on the deliberation results of the Remuneration Committee. It should be noted that remuneration for Directors who are Audit & Supervisory Committee Members shall be determined upon consultation with Directors who are Audit & Supervisory Committee Members.

Total remuneration for each officer category (fiscal 2024)

| Business terms | Total amount of remuneration | Basic remuneration | Performance-based bonus | Stock compensation-type stock options | Restricted stock remuneration | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| by position | Performance-based post-delivery issuance type | |||||||||||

| Number of persons | Total (Millions of yen) | Number of persons | Total (Millions of yen) | Number of persons | Total (Millions of yen) | Number of persons | Total (Millions of yen) | Number of persons | Total (Millions of yen) | Number of persons | Total (Millions of yen) | |

| Director (Of which Outside Directors) |

8 (3) |

226 (38) |

8 (3) |

198 (38) |

4 (-) |

4 (-) |

3 (-) |

4 (-) |

3 (-) |

19 (-) |

3 (-) |

0 (-) |

| Directors who are Audit and Supervisory Committee Members: (Of which Outside Directors) |

3 (2) |

37 (18) |

3 (2) |

37 (18) |

- (-) |

- (-) |

- (-) |

- (-) |

- (-) |

- (-) |

- (-) |

- (-) |

| Audit & Supervisory Board Members (Of which Outside Audit & Supervisory Board Members) |

4 (2) |

22 (9) |

4 (2) |

22 (9) |

- (-) |

- (-) |

- (-) |

- (-) |

- (-) |

- (-) |

- (-) |

- (-) |

| Total | 15 | 286 | 15 | 258 | 4 | 4 | 3 | 4 | 3 | 19 | 3 | 0 |

-

Notes:1.The "Number of persons" refers to the number of persons subject to remuneration for the fiscal year under review, not the number of persons in office.

-

2.Figures are rounded down to the nearest million yen.

-

3.The Company transitioned to a company with Audit and Supervisory Committee structure upon the conclusion of the 83rd Ordinary General Meeting of Shareholders held on June 27, 2024. The remuneration for Audit & Supervisory Board Members relates to the period prior to the transition, while the remuneration for Directors who are Audit and Supervisory Committee Members relates to the period after the transition.

Remuneration Committee

The Remuneration Committee, presided over by an Independent Outside Director, consists of all the Independent Outside Directors who are not Audit and Supervisory Committee Members, along with the Representative Director, President and Chief Executive Officer. For auditing purposes, one member appointed by the Audit and Supervisory Committee attends the Remuneration Committee's meetings. The Committee deliberates on remuneration plans for Directors and Operating Officers as well as the contents of remuneration paid to each Director, and it then reports the deliberation results to the Board of Directors.

| Members | Three Independent Outside Directors, One Inside Director |

|---|---|

|

Seiichi Koike (Chairperson / Independent Outside Director) Masashi Hiraiwa (Independent Outside Director) Emiko Hamada (Independent Outside Director) Katsuya Sase (Representative Director, President and CEO) |

Status of activities of Remuneration Committee (fiscal 2024)

| Number of meetings held | 5 |

|---|---|

| Main matters under deliberation |

|