Spotlight

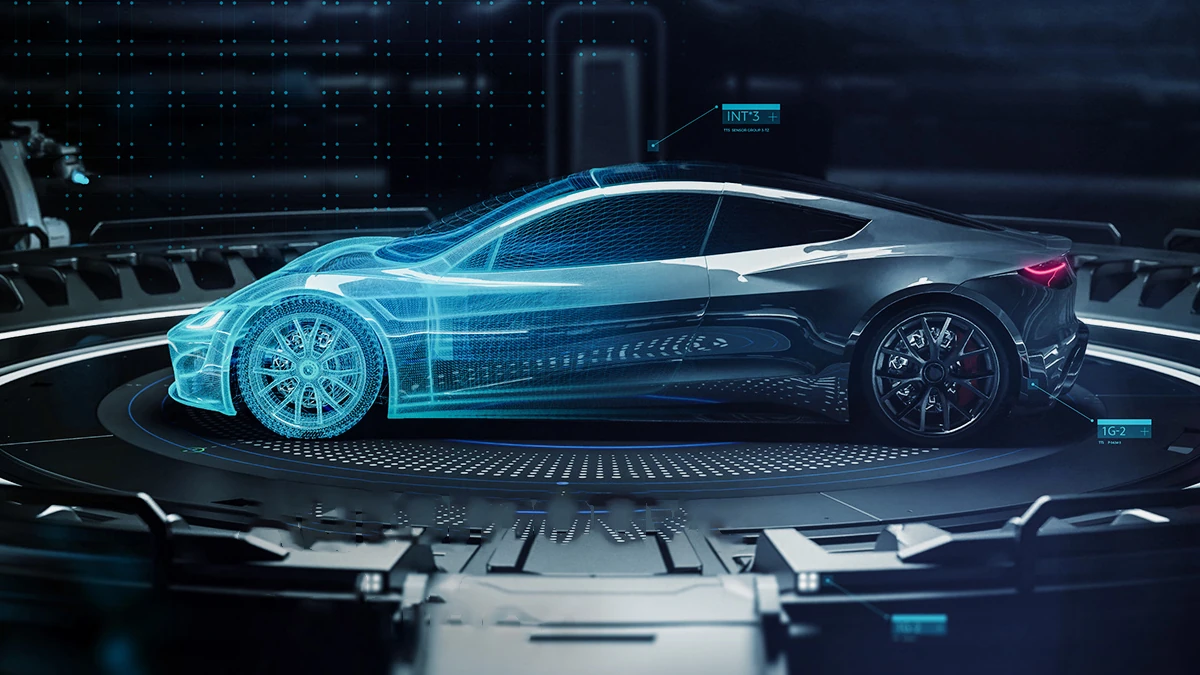

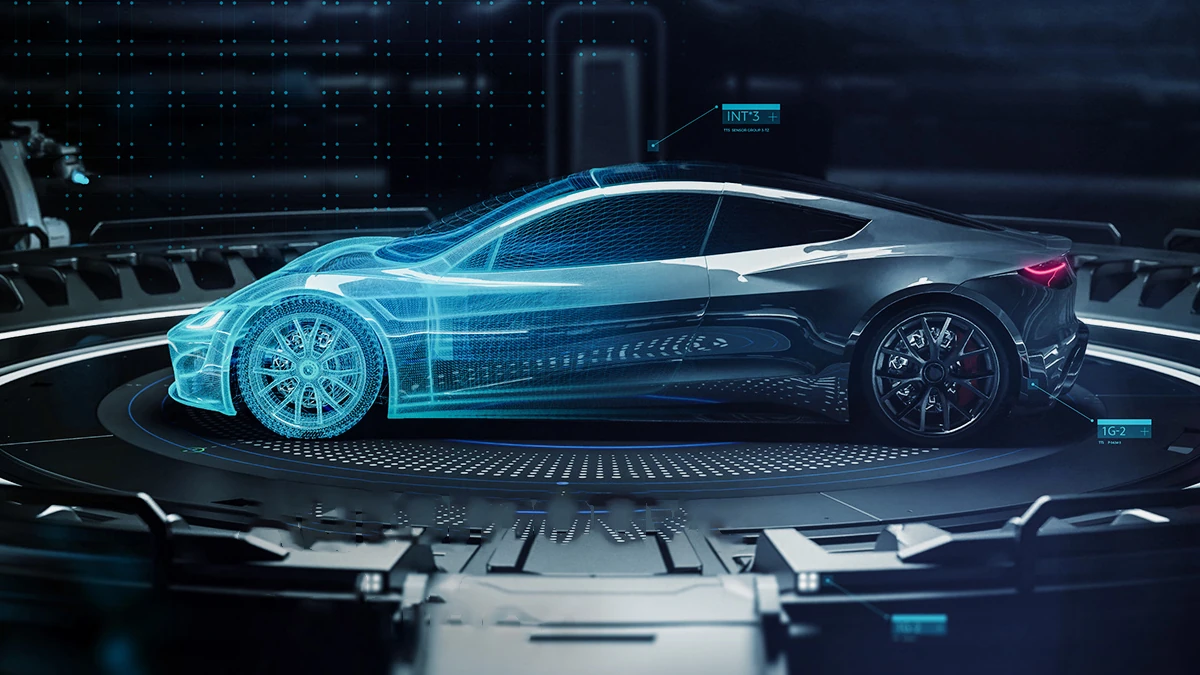

[Special Contents] Regenerative Electric Assist System FEREMO™

- Solution

- Sustainability

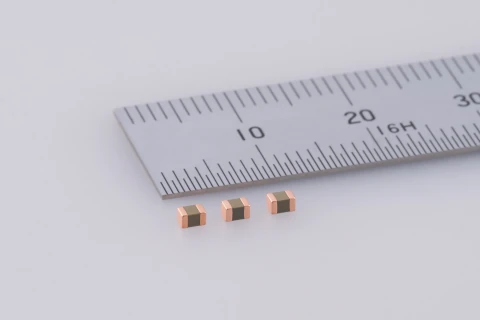

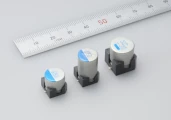

High Reliability Products lineup

- Product

News

Product Search

- Distributor Inventory Search

- North America

- Europe

- Asia Pacific

- Other Regions

[Special Contents] Regenerative Electric Assist System FEREMO™

High Reliability Products lineup