Message from the Officer in charge of Finance

Swiftly seizing upon signs

of change to support

TAIYO YUDEN's efforts in

achieving our goals

Katsuya Sase

Director and Senior Executive Operating Officer

Basic Financial Strategy

TAIYO YUDEN engages in business activity with the aim of achieving its mission, "stronger and more socially aware through the wonders of science." The field of electronics in which we operate is in the process of explosive growth in demand for electronic components as digital transformation progresses in the society. As such, TAIYO YUDEN has made it our basic financial strategy to balance implementing growth investment and maintaining our financial health in order to increase our revenue above and beyond market growth.

We base our financial health around a benchmark 60% equity ratio, a level we have been able to sustain consistently in recent years.

FY2021 Financial Results

Despite the ongoing impacts of the COVID-19 pandemic that have persisted since 2020, the external environment saw demand for electronic components generally remain strong in FY2021 thanks to the computerization and electrification of automobiles as well as proactive investment into IT infrastructure. As a result, net sales increased 16% over the previous year to ¥349.6 billion, and operating income rose 67% over the previous year to ¥68.2 billion. We were able to achieve record profits on every line from net sales to net income attributable to owners of the parent company, and our equity ratio, which we use as an indicator of our financial health, was 63.1%.

Medium-term Management Plan 2025

KPIs

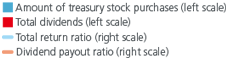

The medium-term management plan 2025 has set KPIs of ¥480 billion net sales, an operating margin of 15% or higher, ROE of 15% or higher, and ROIC of 10% or higher by the final year of the plan. In FY2021, which marked the first year of the plan, we were able to reach our targets for all KPIs except for net sales. We intend to strengthen our efforts so that we hit these KPIs on a consistent basis moving forward.

ROE and ROIC

TAIYO YUDEN's basic policy is to improve ROE by improving profitability. To that end, it is vital that we achieve growth in areas in which we are able to provide high added value. Our focus is on expanding sales in the automotive and IT infrastructure/industrial equipment markets, and we are beginning to see the results of our marketing activities in inductor sales following on our success in capacitors, with sales of metal power inductors and other high-end products on the rise. Meanwhile, we also believe it is important to make appropriate investments and improve the profitability of our business through selection and concentration, and ROIC is used as one means of making such decisions. In FY2021, we transferred the wireless module portion of our integrated modules & devices business.

On top of this, we intend to continue with our efforts to raise our total asset turnover ratio by improving productivity and maintain proper inventory levels reflecting changing conditions, including the demand outlook and the stock needed for our business continuity plan. Moving forward, our basic aim is to achieve both our ROE and ROIC targets by improving profitability through growth.

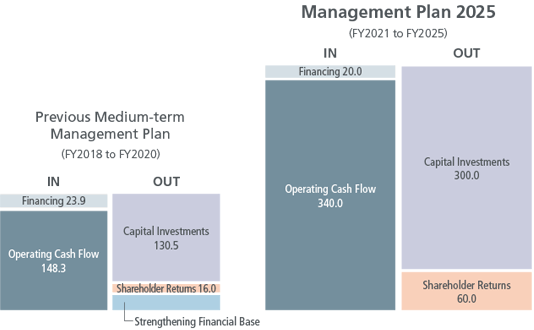

Growth Investment, R&D Expenses, M&A

We plan to make capital investments totaling ¥300 billion over five years through FY2025 as growth investment. In FY2021, the first year of the plan, we invested ¥34 billion and are scheduled to invest ¥60 billion in FY2022, which will include the construction of a new factory in Japan. Moreover, our new multilayer ceramic capacitor (MLCC) factories in China and Malaysia are scheduled to be completed in FY2023. We have structured our investment plan so that our capital investments are higher over the middle portion of the medium-term plan. We also plan to focus our investments into MLCCs and inductors on increasing the production of highly reliable products and high-end products targeting the automotive and IT infrastructure/industrial equipment markets. In particular, we will work to strengthen our MLCC production capabilities by 10-15% every year.

In addition, we have allocated 10% of the ¥300 billion to investments that meet environmental targets and IT investments that will improve the efficiency of business operations. In terms of investments into environmental measures, preparatory construction work to shift our R&D Center to 100% renewable energy as previously announced is set to begin in FY2022, and we expect it to be fully powered by renewables by FY2024.

Our policy on R&D expenses, meanwhile, is to continuously make investments centered on the sophistication of elemental technologies, such as material technology, the creation of solutions, etc. The amount of these investments currently stands at 4% of net sales. Though we believe we are capable of achieving the medium-term management plan 2025 through organic growth, we are always keeping an eye out for M&A opportunities for consideration based on our needs in executing our business strategy as a means of furthering our growth.

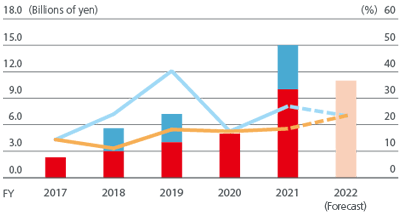

Shareholder Returns

TAIYO YUDEN has set "responsibility to provide returns to shareholders" as one of its management philosophies. We have increased distributions continuously over recent years to fulfil this responsibility, raising the annual dividend per share from ¥20 in FY2017 to ¥80 in FY2021. Going forward, we plan to increase dividends in a stable manner as we strike a balance between growth investment and shareholder returns. Our dividend payout ratio for FY2021 was 18.5%, but the Company plans to aim to realize a dividend payout ratio of 30% once the prospects for any major investments are relatively clear, such as the construction of new factories.

It is our belief that TSR (Total Shareholder Return), a major topic in recent years, is important from an investor's perspective. The Company will focus on profit growth, which will lead to capital gains, and increasing our free cash flow, which will lead to income gains. We will prioritize investments necessary for growth while also working to improve our productivity so as to enhance the efficiency of our investments. At the same time, we take initiatives based on stock market conditions, including the possibility of opportunistic treasury stock buybacks. The medium-term management plan 2025 also includes KPIs for increasing not just economic value but social value in an aim to boost the overall corporate value of the Company. Through these efforts, we hope to achieve more stable growth, meet stakeholder expectations, and ultimately improve TSR.

We are currently in the second year of the medium-term management plan 2025, and there is a need for us to identify early signs of changes in the business environment and business conditions, those that are unfavorable in particular, so that we may take the most appropriate measures. If the role of the CEO is to push the Company forward toward its goals, the role of the chief financial officer is to increase the Company's sensitivity to change and implement measures in response, encouraging stable growth aimed at achieving those goals. As the Company's chief financial officer, I plan to support the execution of the medium-term management plan 2025 by serving as a keen observer attuned to the various changes happening in the market environment as well as our Company's standing.