We will accelerate the pace of implementing measures aimed at positioning TAIYO YUDEN to take the next dramatic leap forward while taking all necessary steps needed to respond the growing demand for electronic components.

Since its founding in 1950, TAIYO YUDEN has engaged in the development, manufacture, and supply of electronic components used in a wide variety of electronic equipment.

The Company’s electronic components, especially its capacitors, are essential to the manufacture of electronic equipment, including smartphones and PCs. Our technology solution provide the underlying strength for the continued technology evolution in the computerization of automobiles, which continues to gather pace, and the imminent emergence of an AI and IoT society. This makes our electronic components increasingly important across all these markets. Against this backdrop, TAIYO YUDEN will continue to engage in the global volume supply of leading-edge, high-quality electronic components that address the needs of customers. In this manner, we will help in the realization of an affluent society while both creating social value and securing the Company’s sustainable growth.

TAIYO YUDEN’s most recent financial results show consolidated sales at a record level climbing 5.8% compared to the previous fiscal year to ¥244.1 billion in the fiscal year ended March 31, 2018. From a profit perspective, operating income jumped 63.3%, to ¥20.2 billion and net income attributable to owners of parent company surged 201.3%, to ¥16.3 billion year on year. Of particular note, sales of capacitors were strong overall, growing across the automotive and industrial equipment as well as other sectors, increasing by a substantial 21.4% from the previous fiscal year.

TAIYO YUDEN expects demand to again expand in the fiscal year ending March 31, 2019, primarily in the automotive and industrial equipment market sectors. On this basis, consolidated sales are forecast to increase 4.5% year on year, to ¥255 billion for a second consecutive year of record-high revenue. While operating income is expected to reach ¥21 billion, an improvement of 3.8% year on year, other expenses are anticipated to exceed other income. Accounting for these factors, net income attributable to owners of parent company is forecast to decline 20.5%, to ¥13 billion. (Full fiscal year forecasts upwardly revised on August 6, 2018.)

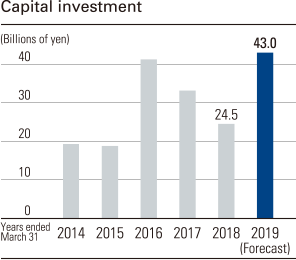

Under these circumstances, TAIYO YUDEN plans to undertake capital investments totaling ¥43 billion in the current fiscal year. This includes the construction of a new capacitor plant located in Japan aimed at addressing the forecast explosive demand for electronic components. As the IoT era firmly takes hold from 2020 and beyond, we will take all necessary steps to prepare for the next dramatic leap forward.

Shoichi Tosaka

President and Chief Executive Officer

Changes in the Business Environment

With the full-scale start of an IoT era imminent, conditions are far removed from the IT bubble period immediately prior to and after the year 2000. At that time, mobile phones were essentially the only device that drove demand for electronic components. Today, the connection of a wide variety of equipment to the Internet is fueling advances in IoT across an increasingly broad area while also accommodating dramatic increases in the volume of data. A prime example is the automobile and related technologies in that market sector.

We are seeing continued progress in the computerization of cars across the entire industry. This trend is reinforced by commitments at the national level to promote the development of electric vehicles and automatic operating systems. This is especially the case for Europe, where environmental regulations are extremely stringent, and China, which continues to implement public policies at a comparatively fast pace. As a result, electronic components are being used for a wide variety of applications in the automotive field. In addition, IoT is also advancing quickly in prominence in the industrial equipment field. In addition to rapid developments in Industry 4.0 and other trends, activities are expected to extend strongly in the health and nursing care fields.

We anticipate these trends will accelerate demand for electronic components at an extreme pace around 2020 with the full-scale introduction of 5G (fifth generation mobile communications). As a result, demand for data centers that are capable of collecting, storing, and analyzing data is expected to expand at a rapid pace. When you combine each of these factors, the electronic component sector will without a doubt enter a period of explosive demand growth.

Medium-term Management Plan

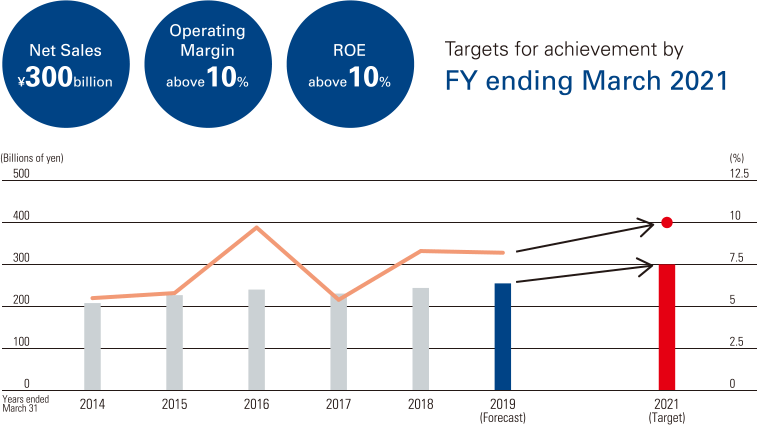

In addition to this projected growth in electronic component demand, we are witnessing improvements in our traditional business structure that is dependent upon smartphones. In light of these developments and under our Merium-term Management Plan, we are targeting net sales of ¥300 billion, an operating margin of 10% or more, and ROE of 10% or more by the fiscal year ending March 31, 2021. In order to achieve these targets, we will engage in three key initiatives, which are (1) expanding focus markets, (2) promoting further advancements in manufacturing, and (3) shifting to aggressive capital investment.

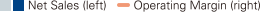

To address our aim of expanding focus markets, we will look to extend the composition of automobiles and industrial equipment sales as a percent of our total sales from 31% in the fiscal year ended March 31, 2018 to 38% by the fiscal year ending March 31, 2021. For automobiles alone, the goal is to increase the composition of sales from 9% to 15% over the aforementioned period.

Turning to efforts aimed at promoting further advancements in manufacturing, we will put in place a production framework that is capable of efficiently undertaking higher levels of volume production on a location free basis under TAIYO YUDEN’s productivity improvement initiative, the smart.E Project. This project was launched in the fiscal year ended March 31, 2017. Finally, we will further ramp up aggressive capital investments and dramatically increase production capacity focusing mainly on capacitors.

Cultivating Focus Markets

Among focus markets under its Medium-term Management Plan, TAIYO YUDEN places the utmost importance on the automobile sector where demand for electronic components has expanded rapidly over recent years. Based on the Company’s estimates, the average electric vehicle uses 14,000 electronic components compared with 6,300 for a middle-class gasoline-powered automobile. Of this total, roughly one half are multilayer ceramic capacitors. Notwithstanding our position as a generic manufacturer in the automotive market, our entry coincided with a period of high demand for electronic components. This largely reflects developments in safety performance and the shift toward electric vehicles. As a result, we continue to enjoy an average annual sales growth rate of 35% in the automotive market, which far outstrips the rate of market expansion.

In the industrial equipment market, demand for highly reliable, high capacitance, high voltage resistant electronic components is rising sharply. In the environmental and energy market as well as the medical and healthcare market, we are targeting opportunities in high-value-added businesses by putting forward solution proposals that bring together the Company’s elemental technologies and software.

The automotive and industrial equipment markets are little affected by seasonal factors and cycles of equipment demand. Sales growth in each of these fields is helping to stabilize the Company’s production facility operations. To date, TAIYO YUDEN’s operating margin has generally hovered around 5% plus or minus 5%. In favorable years, our operating margin has ballooned to nearly 10% owing mainly to production trends for such devices as mobile and smartphones and movements in foreign currency exchange rates. As conditions turn the other way, we have seen sudden drops in profit which has led to an unstable earnings structure.

However, as automotive- and industrial equipment-related sales make up a higher percentage of total sales, we are securing a certain level of profit even in years when external conditions deteriorate. This will drive a shift toward a corporate structure that is capable of continuous growth. Looking ahead, we will improve our earnings structure and transition to a company that maintains a stable operating margin of 10% plus or minus 5% over the medium term.

■ Sales Composition by Market Sector

Advancements in Manufacturing

TAIYO YUDEN is now in the third year of its smart.E Project that began in the fiscal year ended March 31, 2017. This project is designed to “promote advancements in manufacturing,” an initiative under the Company’s Medium-term Management Plan. Under this project, we are working to improve yields by eliminating inconsistencies in equipment and personnel. At the same time, we are endeavoring to achieve the ultimate goal of zero defects by uncovering the reasons for faults and malfunction and implementing immediate and proper corrective actions.

As a part of efforts to visualize the labor force, we have been monitoring the behavior of operators across each operating process and worked to identify the reasons behind inconsistencies in operator productivity and the rate of defects. Armed with this information, we are encouraging operators to align their activities to the standards set by operators who continue to work at a high level. Coupled with efforts to uncover production equipment abnormalities at an early stage, these endeavors are projected to generate productivity improvements of around 30% compared with existing levels for certain processes.

Building on the results of efforts aimed at visualizing equipment and the labor force, we have initiated steps to prevent abnormalities. By eliminating muda (wastefulness), mura (inconsistency), and muri (overburden) with respect to both equipment and the labor force, we are confident that we are steadily approaching our goal of zero defects. While the focus of the smart.E Project has to date been mainly in production bases in Japan, we are at the same time extending the project to overseas production bases. Our goal is to have a borderless production network.

A smart.E Project activity

Capital as well as Research and Development Investment

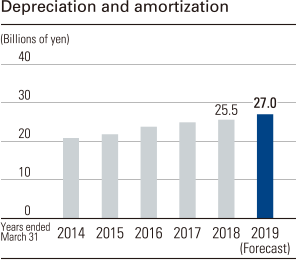

Turning to the third initiative under the Medium-term Management Plan, a shift to aggressive capital investment, TAIYO YUDEN has over the past three years undertaken expenditures totaling ¥100 billion. In a bid to further expand its business scale and address the projected explosive demand for electronic components, the Company will lift this expenditure to ¥150 billion over the next three years. Every effort will be made to continuously expand capacity.

Work on a new capacitor manufacturing facility at the Company’s subsidiary, NIIGATA TAIYO YUDEN CO., LTD., is scheduled for completion at the end of 2018. Over and above the aforementioned, we understand there is a need to strengthen our production network. This includes the construction of another plant facility. Pressed by ongoing advancements in manufacturing, our policy is to accelerate the pace of capital investment while minimizing losses and greatly improving productivity.

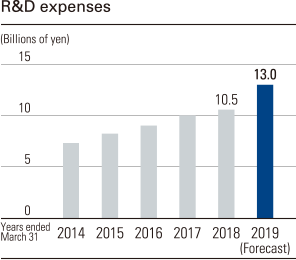

Meanwhile, we will maintain an aggressive approach toward R&D investment. In addition to the development of products including capacitors, inductors, and communication devices, we will focus on creating new businesses through solution proposals.

Strategies That Address Environmental, Social, and Governance (ESG) Concerns

TAIYO YUDEN is committed to fulfilling its management vision, “to be an excellent company that enjoys the trust and highest regard from its customers,” to help build an affluent society and resolve social challenge through the development and supply of smart products*.

The adoption of sustainability development goals (SDGs) by the United Nations and growing ESG investment by investors are just a few examples of society’s mounting expectation toward the corporate sector to engage in sustainable business activities that emphasize ESG concerns. TAIYO YUDEN is working to share throughout the Company future business opportunities and risks that touch on ESG concerns while addressing specified issues.

For example, we are endeavoring to contribute to the environment through our product strategy. Strongly recognizing that climate change will have a massive impact on the future, we are making every effort to reduce CO2 emissions and energy consumption across our manufacturing process, as an important environmental issue, in a bid to help realize a zero carbon society. Furthermore, as a company that undertakes business activities globally, we are aware of the importance of human rights as a core social concern. We closely monitor issues such as forced labor, child labor, working conditions, harassment, and discrimination, and pay the utmost respect to the right of all individuals in the conduct of our business activities worldwide.

As far as governance is concerned, we recognize the critical need to clarify the ideal scenario for the Company five and 10 years down the road in order to ensure the proper development of the corporate governance function. After objectively analyzing any discrepancies between the current status of governance within the Company and the aforementioned ideal scenario, we must take steps to fill this gap. Improving governance as merely a formality makes little to no sense. Our goal is to develop an effective governance framework.

Further to this objective and in order to bolster global governance, we are putting in place a framework that is capable of monitoring the status of our overseas operations, by reinforcing the audit of overseas subsidiaries.

From a succession planning perspective, TAIYO YUDEN will introduce an executive coaching program for candidates who the Company believes have the potential to lead in the future. Through this program, we will promote the development of the necessary skills for candidates to carry the Company forward, with a broader perspective and deeper insight.

Looking ahead, we will continue to bolster activities aimed at addressing ESG concerns.

* Smart products: Highly reliable and safe products that are energy efficient and do not employ hazardous materials.

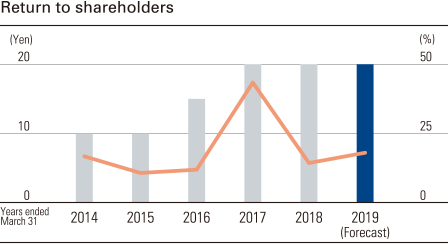

Returning Profits to Shareholders

TAIYO YUDEN has positioned the “responsibility to provide returns to shareholders” as a key component of its management philosophy. As such, returning profits to shareholders is of particular importance to the company’s management group. Our policy is to target a total return ratio of 30% through such measures as the acquisition of treasury stock while building a stable and sustainable earnings structure and improving our financial foundation, which includes maintaining a positive net cash position.

TAIYO YUDEN is currently in a critical period and recognizes the need to invest for growth to prepare for the future. This reflects expanding demand for electronic components in line with the development of an IoT society. While a little time will be required before achieving a total return ratio of 30%, we will endeavor to return profits to shareholders on a stable basis in line with the target levels according to improvements in our cash position.