Message from the Officer in charge of Finance

Supporting the realization of Medium-term Management Plan 2025, which targets net sales of ¥480 billion and ROE of 15% or higher, from financial aspects

Katsuya Sase

Director and Senior Executive Operating Officer

FY2020 Results and Summary of Previous Medium-term Management Plan

FY2020 started with the situation in which it was difficult to predict what impact the spread of COVID-19 infections, which had broken out around the world from the beginning of the year, would have on TAIYO YUDEN's business. In actual fact, however, owing to the increased demand for electronic components brought about by the increases in telecommuting and home study using electronic devices such as personal computers, the use of parts for the production of smartphones, and the faster than expected recovery of automobile production, the positive impact on TAIYO YUDEN's business performance was significant, and both sales and profit reached record highs.

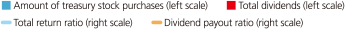

As a result, we were able to achieve our targets for the previous medium-term management plan, for which FY2020 was the final year, with net sales of ¥300.9 billion and ROE of 12.6%. The operating margin did not reach the target of 15%, but I believe it is rather important that we have been able to consistently achieve the 13% level for three years. It is also commendable that we have maintained an equity ratio of 60% or higher and realized a substantial net cash position.

One of the factors that can be mentioned as having contributed to the achievement of these results is the improvement in customer mix. As a result of having defined automobiles and IT infrastructure/industrial equipment as "focus markets" and having conducted activities to expand the sales composition ratio, we were able to approach the target ratio and greatly contributed to the achievement of the target. The focus market ratio, which was 32% before the start of the previous medium-term management plan, expanded to 43% in the final year of the plan. This is the result of the efforts we have made in the past nine years, not only during the period of the plan, but even before the plan started.

■Previous Medium-term Management Plan

Medium-term Management Plan 2025

Numerical Targets and Plan Period

Under the medium-term management plan 2025, the Company has set as numerical targets net sales of ¥480 billion, operating margin of 15% or higher, ROE of 15% or higher, and ROIC of 10% or higher. The duration of the plan period is five years, and we will make brave investment decisions in anticipation of medium- to long-term demand trends.

ROE and ROIC

We will aim to achieve both the ROE and ROIC targets by improving profitability through growth.

With regard to ROE, based on the actual result of 12.6% for FY2020, we will implement a growth strategy in line with the expansion of the market, and at the same time will achieve the target of 15% or higher by strengthening the profitability of inductors and communications devices that did not reach their targets in the previous medium-term management plan.

In addition, we have newly adopted ROIC as one of the numerical targets from a perspective of management that is conscious of capital costs. TAIYO YUDEN's current weighted average cost of capital (WACC) is estimated to be about 8%, and on the major premise that ROIC needs to exceed that, we have set the ROIC target at 10% or higher. In actual operations, we will break down ROIC by product category to keep track of the status on a regular basis. When making an investment, we will set criteria such as the payback period and utilize them to promote selection and concentration of businesses more than before.

On the other hand, in preparation for unforeseen circumstances, such as a sudden deterioration of the macro economy, natural disasters, and pandemics, from past experiences we consider it indispensable to secure the depth of equity capital and ensure safety for business continuity. In connection with this, although we did not actually use it in the previous fiscal year, we have increased our commitment line with banks from ¥10 billion to ¥30 billion.

While maintaining the current equity ratio of 60% level, we will aim to raise ROE and ROIC by improving profitability in each business.

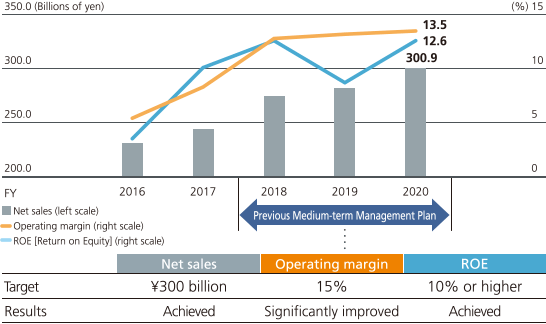

Growth Investment, M&A, R&D Expenses

As a growth investment to achieve the medium-term management plan 2025, we plan to make a total capital investment of ¥300 billion over the five-year period, ¥50 billion of which is scheduled to be invested in the first year, FY2021. The targets for investment are mainly high-reliability markets, such as automobiles and IT infrastructure/industrial equipment, and high-end markets such as telecommunications. We are going to strengthen our capacitor production capabilities by 10-15% every year, and invest in new products for inductors and communications devices. We are also planning to construct new factories in Japan, China and Malaysia going forward. As investment in preparation for growing demand is scheduled ahead of time, there is the possibility that the balance may change temporarily, but we will continue to make efforts to maintain a strong financial position.

We also plan to allocate about 10% of our investment plan of ¥300 billion to investments that meet environmental targets and IT investments that will improve the efficiency of business operations. The incorporation of external resources such as M&A can be considered as one of the means of growth but is not included in the investment amount under this plan. Based on organic growth, we will continue research to explore the M&A possibilities and will consider them as and when necessary for strategic execution going forward.

In contrast, R&D expenses will be maintained at the 4% level of net sales, centering on the sophistication of elemental technologies, such as material technology, and the creation of solutions. We believe that 4% remains a necessary and sufficient level to tackle the themes that are currently appearing, but we will flexibly respond to needs, such as initiatives for new businesses.

■Capital Investment/Depreciation and Amortization

Shareholder Returns

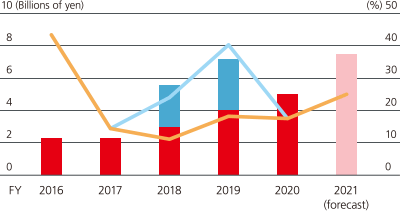

TAIYO YUDEN has adopted "Responsibility to Provide Returns to Shareholders" as part of its management philosophy. The Company has increased the annual dividend from ¥20 per share in FY2017, to ¥40 per share in FY2020.

In the medium-term management plan 2025, we have set the goal of realizing a stable dividend payout ratio of 30%. We aim to return profits to our shareholders by paying cash dividends according to the level of profit. In the future, as in the past, we will endeavor to increase the cash dividend amount in a stable manner while considering the balance with growth investment. On the other hand, we will proceed with the acquisition of treasury stock as necessary to improve the total return ratio.

■Returning Profits to Shareholders