Message from the Officer in charge of Finance

Improving profitability

and concentrating on

high value-added areas

to

accelerate growth

Tomomitsu Fukuda

Director and Senior

Executive Operating Officer

in charge of Management Planning Headquarters

FY2024 Financial Results and FY2025 OutlookExpanding Sales for Automotive and AI Server Applications and Implementing Structural Reforms

In FY2024, despite a challenging market environment, we were able to record higher net sales and operating profit. However, ordinary profit and net profit decreased mainly due to foreign exchange impacts. By product, demand for inductors, in particular, exceeded our initial expectations. Sales increased for game console and memory module applications, among others. In multilayer ceramic capacitors (MLCCs), sales for automotive and AI server applications expanded. On the other hand, conditions in the communication devices business remain challenging owing to the continued sluggishness in high-end smartphones in China, which has prompted us to implement structural reforms in a bid to restructure the business.

In FY2025, while we anticipate a slight year-on-year decrease in net sales, to ¥340 billion, we forecast higher operating profit of ¥16 billion on the back of capacity utilization efforts. Our assumptions include stronger demand for electronic components, particularly MLCCs, driven primarily by automotive and AI server applications. On the other hand, we have factored in a negative impact on net sales of approximately ¥9 billion in relation to US tariff policies. Considering that our sales weighting to North America is in the 6% range, the direct impacts will be limited, however, the indirect repercussions remain to be seen. Our earnings forecasts reflect the risk of a potential decrease in demand due to cost pass-alongs to end products.

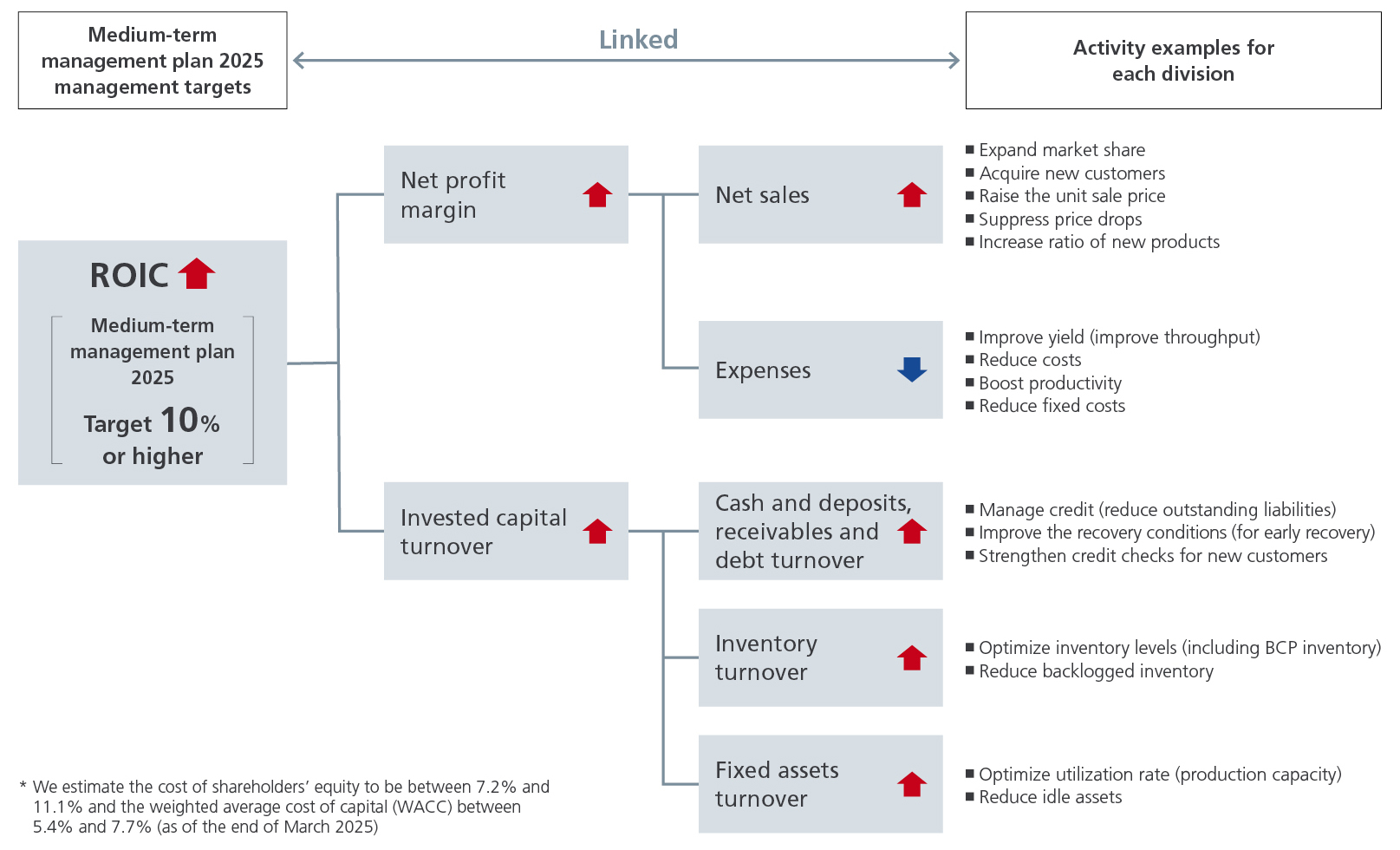

ROIC Improvement MeasuresROIC Management-Driven Selection and Concentration

We have been executing the 5-year medium-term management plan 2025 since FY2021. We traditionally emphasized operating profit and the operating margin in the course of managing the Company. Starting with the medium-term management plan 2025, we have incorporated a style of management based on ROIC (return on invested capital). We consider ROIC a yardstick for decision-making and have pressed ahead with a selection and concentration strategy based on the positioning of ROIC in each business. In particular, in the integrated modules & devices business, we have restructured operations in circuit modules due to low margins and limited future growth potential, and reallocated management resources to high value-added areas.

This ROIC management has led to a change in awareness even among working-level staff. In each division, understanding how one’s activities impact ROIC and the share price, along with visualizing the cause-and-effect relationship for improvement, has facilitated smoother goal setting and execution.

However, when ROIC is broken down into profitability and efficiency, there is still work to be done to improve the invested capital turnover ratio and other markers of efficiency. Due to geopolitical risks and supply chain circumstances, we have been forced to maintain higher inventory levels than usual as BCP inventory, which has dragged down efficiency. Therefore, based on the idea of making up for these efficiency issues through improved profitability, we are taking steps to brush up our business operations.

As for our business portfolio, we arranged for independent profitability assessments to be conducted on each product category to aid our decisions on selection and concentration. Since FY2024, we have implemented structural reforms in the communication devices business, where earnings have deteriorated. Within the framework of a single segment—in this case, the electronic components business—we evaluate and determine what products to offer in which markets. Our policy going forward will be to focus more of our attention on high value-added zones.

Medium-Term Management Plan 2025Results of the Medium-Term

Management Plan 2025

and Outlook for Future Growth

As President Sase mentioned, it is unlikely that we will achieve the financial targets of the medium-term management plan 2025 in the final year, which we set at the start of the plan. Nevertheless, we have steadily invested in future growth. We established new production plants for MLCCs in China and Malaysia, thereby augmenting our production capacity. We have maintained R&D expenses at just over 4% of net sales, thus strengthening our responsiveness in the high-end sector. While the outcome of the medium-term management plan 2025 will be a tough pill to swallow, preparations for the next medium-term management plan are already underway. We aim to use the measures we have employed thus far as a foundation to respond to the next phase of demand expansion and achieve growth in the next plan.

Capital AllocationGrowth Investments with an Eye to the Future

Even Under Tough Conditions

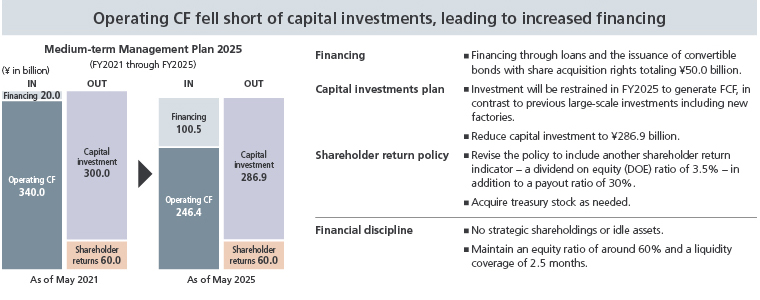

During the period of the medium-term management plan 2025, we made the decision to continue with growth investments even in the face of challenging conditions, such as sluggish demand and reduced cash inflows. Based on medium- and long-term demand forecasts, we thought that capacity expansion in preparation for future growth should continue, which is why we have continued to execute capital investments primarily in MLCCs.

In MLCCs, while demand for small-sized products for smartphones has slowed, the demand for highly reliable, high-capacity large-sized products for automotive and AI server applications has expanded at a pace greater than we expected. In response to this change in demand, we revised the investment plan in the medium-term management plan 2025, shifted our focus to large-sized products, and continued to ramp up capacity. The conviction that even in tough times, the investment decisions made now will support our future competitiveness stems from lessons learned from past experi-ences where our hesitation to invest during similar situations led to opportunity losses after demand recovered, ultimately widening the gap between us and the competition.

Initially, we planned to cover the majority of cash outflows for capital investments and other expenses with cash flow from operating activities. However, weak demand meant we had to seek new sources of funding to meet the shortfall. In 2023, we issued ¥50.0 billion in convertible bonds with share acquisition rights, securing a framework to support growth investments while ensuring financial stability.

During the period of the medium-term management plan 2025, free cash flow remained in negative territory, which only increased our net debt. However, because large investments wound down and capital investment decreased in FY2024, I believe free cash flow in FY2025 can return to a level close to breakeven. In the next medium-term management plan kicking off next fiscal year, we will aim to consistently generate free cash flow and make sure it stays on the positive side of the ledger each year.

Shareholder ReturnsValuing the Stability of Dividends and Adopting DOE

Until now, our shareholder returns policy targets a dividend payout ratio of 30%. In addition to this, we have newly adopted DOE (dividend on equity) as an indicator. The adoption of DOE demonstrates our commitment to maintaining an emphasis on dividend stability, regardless of temporary fluctuations in earnings. This crystallizes our responsibility to provide returns to shareholders, as stated in our management philosophy, and is considered a part of our financial strategy that supports our reliability as a corporation. As we belong to a highly volatile industry, we recognize that hiking dividends when profits go up and maintaining a certain level of dividends even when profits go down is the kind of stability that serves as a solid foundation for enhancing long-term corporate value.

To Our Stakeholders

The latter half of the five-year medium-term management plan 2025 was marked by several challenging phases. As a result, we will most likely undershoot the financial KPIs in the plan. However, I feel confident that we have steadily made preparations that will translate to future growth. That is precisely why we are determined to achieve the KPIs set out in the next medium-term management plan.

In addition, I want to focus not only on planning and execution, but also on communicating our efforts. I will continue to enhance dialogue and information disclosure with shareholders and investors and actively keep you updated on the Company’s direction.