Message from the Officer in charge of Finance

Director, Executive Operating Officer

Tomomitsu Fukuda

In June 2023, I was appointed Chief of Management Planning Headquarters, which oversees finance. After joining TAIYO YUDEN, I was involved in business management and management planning for a long time, and I have also led M&A projects. Through these activities, I was able to develop the skills to think about things from the perspective of how to increase the corporate value of TAIYO YUDEN. I believe that the role of financial strategy is to support business strategy, and my role is to provide leadership as a financial officer while guiding the business strategy to fruition. I will continue to drive our financial strategy forward with a firm grasp of the benchmarks that will enable TAIYO YUDEN to generate returns that exceed capital costs.

Growth Investment Policy in the Medium-term Management Plan 2025

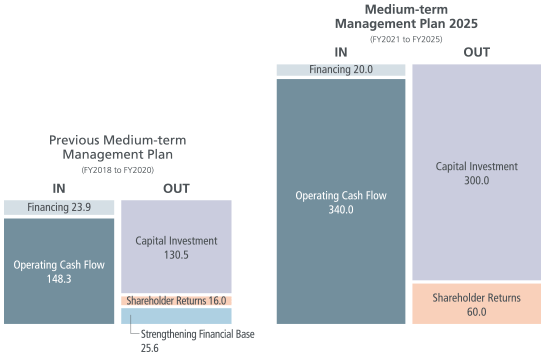

The medium-term management plan 2025 that we are currently working under represents a change in the way we think about growth investment compared to the past. When I joined TAIYO YUDEN back in the 1990s, it styled itself as a prudent company run on a debt-free basis, and even in later years, when demand or economic trends worsened, it often scaled back investments. There are cases where such investment decisions are necessary. On the other hand, I have also noticed that companies that have made upfront investments with debt amid expanding demand and companies that have continued investing certain amounts with confidence in future market growth even amidst deteriorating macroeconomic conditions have outpaced their competitors in subsequent growth rates by a wide margin. Looking back on that time, I learned that the companies that grow are those that invest in anticipation of future demand, rather than getting too caught up in the immediate situation.

Electronic components, including multilayer ceramic capacitors (MLCCs), are entering a period of expanding demand, with the main growth drivers being demand in automobiles and in IT infrastructure/industrial equipment. At this juncture, we are therefore shifting our financial strategy in the direction of achieving medium-term growth by making upfront investments with a view to future market growth based on past lessons. To secure funds for medium- to long-term growth at low cost and to build a stronger financial base, the Company has decided to issue Euro Yen zero coupon convertible bonds due 2030 as a financing method that will enable us to expand our capital in accordance with the future business environment and financial situation.

FY2022 Summary and FY2023 Outlook

In FY2022, the second year of the medium-term management plan 2025, net sales fell to ¥319.5 billion (down 8.6% from the previous fiscal year) and operating profit fell to ¥31.9 billion (down 53.1% from the previous fiscal year). Until FY2021, we were able to achieve very good results thanks to the effects of our product strategy and growth investments coupled with a positive external environment. Subsequently, however, the rapid deterioration of market conditions led to an unfavorable outcome in FY2022. In retrospect, I now wonder if we could have narrowed the contraction in sales and profits a bit more by sensing the change in the tide earlier, reducing inventory of underperforming smartphone products, and allocating more resources to automotive products, which were performing well. Based on these lessons from the past, going forward we would monitor market trends more closely than ever before and be more future-oriented in our actions and decisions so that we can respond to changes quickly.

In FY2023, which is the third year and the mid-point of the medium-term management plan 2025, we forecast a slight increase in net sales and a decline in operating profit compared to the previous fiscal year. The assumption behind this forecast is that it will take some more time for the market to recover, especially for smartphones, PCs, and data centers. For this reason, we plan to focus more on automobiles, where demand is relatively robust. While we anticipate that our financial situation will continue to be severe, partly due to an increase in fixed costs associated with upfront investments, we will thoroughly improve productivity and control costs through acceleration of our "smart.E" productivity improvement activities.

ROIC

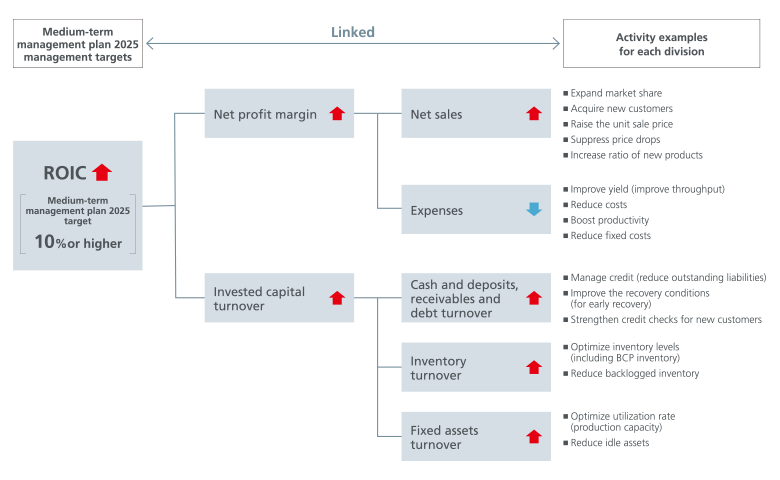

As I mentioned earlier, I place great importance on the measurement of corporate value, especially ROIC, which is a measure of management efficiency. We have set an ROIC target of 10% or higher in the medium-term management plan 2025. However, it goes without saying that improving ROIC is not something that can be done by the Management Planning Division alone, and requires a Company-wide effort, including business and sales departments.

The Management Planning Division calculates the ROIC for each business and regularly reports it at meetings, thereby encouraging each business division to operate its business with the aim of achieving ROIC of 10% or higher. The efforts necessary to improve ROIC must be made at the frontlines—manufacturing, sales, and so on. We are working to spread ROIC management by disaggregating ROIC into a tree structure and showing how it relates to frontline activities in a way that is easy to understand, with the goal of instilling ROIC management consciousness and creating a mechanism by which ROIC rises through the activities of each division.

Capital Allocation

Regarding capital allocation, which is the basis of financial strategy, we intend to generate cash for growth-related investments and the equivalent amount of a dividend payout ratio of 30% for shareholder returns, primarily from operating cash flow. The medium-term management plan 2025 does not call for increasing the balance of interest-bearing debt. However, there is a possibility that the cash inflow for FY2023 will be slightly short of the medium-term management plan, so if it is necessary to increase debt in order to carry out growth investments, we are considering the option of doing so.

On the other hand, with regard to financial soundness, given the volatility of the electronic components industry, I believe it is necessary to maintain a certain equity ratio. Our basic policy is to maintain an equity ratio of approximately 60% as a guideline value.

One of the largest categories of cash outflow, M&A expenses, are not incorporated into the medium-term management plan 2025. However, believing that it can be a vehicle for growth, we are always watching for M&A deals that will contribute to the Company's growth. As with ROIC, one of our criteria is whether we can obtain profits that exceed the cost of capital.

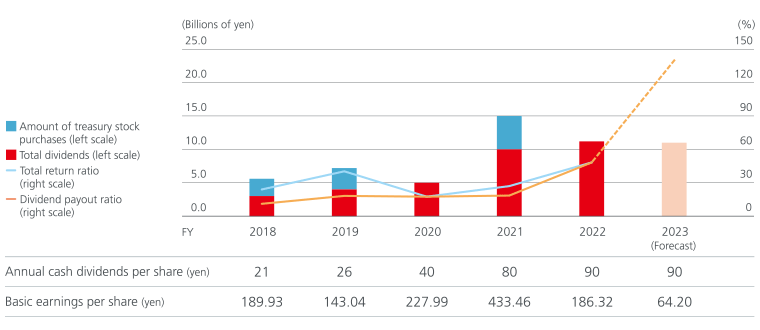

Shareholder Returns

In FY2022, even though profit was lower than the initial plan, we paid dividends in line with the initial plan. We plan to pay the same dividend amount in FY2023 as in the previous fiscal year. As a result, the dividend payout ratio for both fiscal years will exceed the target of 30%, but this is based on the judgment that the low profit level during this period is temporary, and we hope to achieve a stable dividend payout ratio of 30% as soon as possible once earnings recover.

As a corporate manager, I am aware of TSR (Total Shareholder Return), a major topic in recent years, and I also keep a close eye on our share price. On the other hand, I still believe that the root of corporate value is the increase in economic value through profit generation and the increase in social value through non-financial initiatives such as ESG, and I view the share price as an evaluation of this.

Communication with Investors

In corporate management, communication with shareholders and investors is indispensable. In fact, we place importance on dialogue with all stakeholders, and opinions received at shareholder meetings, financial results briefings, individual interviews, and other forums are reported to the Board of Directors for discussion. The President & CEO and I, in my capacity as officer in charge of finance, will continue to provide opportunities for direct dialogue with investors, under the belief that outside perspectives and ideas will play an important role in improving TAIYO YUDEN's corporate value.