Message from the Officer in charge of Finance

Promoting a financial strategy that is mindful of management efficiency and supports our business strategies

Director, Executive Operating Officer in charge of Management Planning Headquarters

Tomomitsu Fukuda

FY2023 Summary

FY2023 was the third year of the medium-term management plan 2025 and I sensed it would be a crucial 12 months for achieving the targets in the plan. However, operating profit fell sharply to ¥9.0 billion (down 71.6% YoY), despite an increase in net sales to ¥322.6 billion (up 1.0%).

The factors behind this were the longer-than-expected inventory adjustments in various markets, which depressed sales volumes. Also, in response to the prolonged market downturn, we curtailed production to reduce our own inventory, which dragged down our capacity utilization rate. Profit was also weighed down by the impact of selling prices due to changes in the customer mix.

Despite the challenging conditions for earnings, we believe medium-term demand growth for semiconductors, driven mainly by AI servers, remains firm, along with sustained demand for passive components, our mainstay products. For these reasons, we proceeded as planned with future-oriented investments in production capacity expansion and human capital.

FY2024 Outlook

In FY2024, we expect to see a market recovery; we forecast net sales of ¥350 billion (up 8.5% YoY) and operating profit of ¥20 billion (up 120%). We think contributions to sales growth will come from the winding down of inventory adjustments in each market, as well as a recovery in demand for information devices—chiefly tablets and PCs—and also for IT infrastructure/industrial equipment, such as AI servers. Furthermore, we expect to rebuild our inventory (which we reduced in FY2023) by approximately ¥10 billion in FY2024, in line with a market recovery, which we believe will contribute to profit improvement through higher capacity utilization. Based on the above, we forecast an increase in sales and sharp profit growth in FY2024.

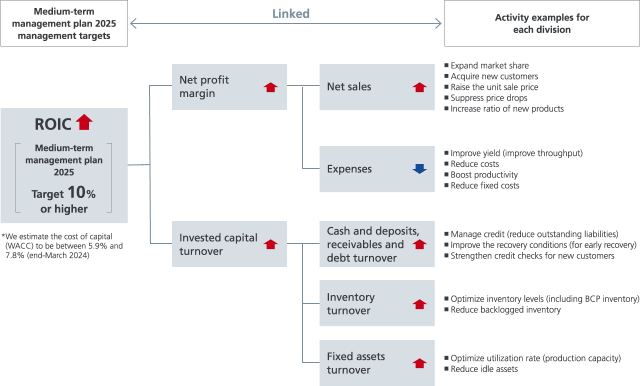

ROIC Improvement Measures

To enhance corporate value over the medium-to-long term, it is essential that we have a metric to measure whether we are heading in the right direction. We stress the importance of ROIC as a key metric, so in our medium-term management plan that concludes in FY2025, we are targeting an ROE of 15% or higher and an ROIC of at least 10%. In FY2023, both the operating margin and invested capital turnover declined, which meant that we fell short of our ROE and ROIC targets. I should also add that we periodically review the cost of capital—as of the end of March 2024, we estimate the cost of shareholders’ equity to be between 7.7% and 11.2%, and the weighted average cost of capital (WACC) between 5.9% and 7.8%.

When it comes to ROIC, we need to do more than just target 10%. We must break down the factors that contribute to the achievement of such a goal and engage the entire Company, including business divisions and sales departments, in addressing each of these factors. As illustrated in the diagram below, activity goals have been established in each division and their KPIs are managed for the purpose of checking whether improvements in management efficiency are being realized in each division. While each business division is responsible for setting their own KPIs, I feel that an awareness of management efficiency and asset efficiency has taken hold throughout the Company, and efforts aimed at improving ROIC, even on the production frontlines, are progressing well.

Going forward, we plan to steadily implement the key measures outlined in the medium-term management plan 2025 (product strategy, market strategy, financial strategy, and ESG initiatives) so as to enhance corporate value with an optimal balance of both economic and social value, while also working to improve ROE and ROIC.

Progress of the Medium-term Management Plan 2025

FY2024 will be the fourth year in our five-year medium-term management plan. After kicking off the plan in FY2021, we unavoidably recorded profit declines in FY2022 and FY2023 due to the impacts of global supply chain disruptions and a market downturn triggered by the COVID-19 pandemic. Now that we have finally broken free of the shackles from that period, net sales are heading for a recovery, with profits to follow suit. Our current outlook is that earnings will improve this fiscal year and in the next. Our net sales target of ¥480 billion for FY2025, the final year of the plan, is ambitious, but we will press ahead with measures geared towards achieving the medium-term management plan 2025.

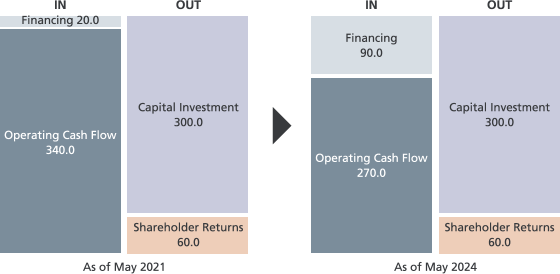

Capital Allocation

The basic policy of our financial strategy is to balance the execution of growth investments with financial soundness. To that end, we aim to maintain an equity ratio of around 60% while executing growth investments. Based on this approach, for capital allocation, we generate cash for growth-related investments and shareholder returns primarily from operating cash flow. We had planned to allocate operating cash flow of ¥340 billion and ¥20 billion in funds raised to finance capital investments of ¥300 billion and shareholder returns of ¥60 billion in the medium-term management plan 2025.

However, as I have already explained, because we booked lower profits in FY2022 and FY2023, we anticipate that cumulative operating cash flow will fall short of our estimate. At the same time, putting off production capacity expansion plans, particularly for MLCCs for which demand continues to grow, is not an option for us if we are to generate medium-to-long-term growth.

We do not hold any strategic shareholdings or idle assets such as unused real estate, while in terms of cash and deposits, we maintain a lean structure with enough liquidity on hand to ensure stable business operations. Therefore, to raise the funds needed for growth investments and the like, in October of last year we raised ¥50 billion by issuing convertible bonds with share acquisition rights. I recognize that this method of financing offers few benefits to existing shareholders, but given the future likelihood of unforeseen geopolitical risks akin to the situation between Russia and Ukraine, along with rising interest rates driven by inflation, as well as the uncertain outlook for the future, we made this decision to mitigate financial risks as much as possible. I hope you understand the rationale behind this decision.

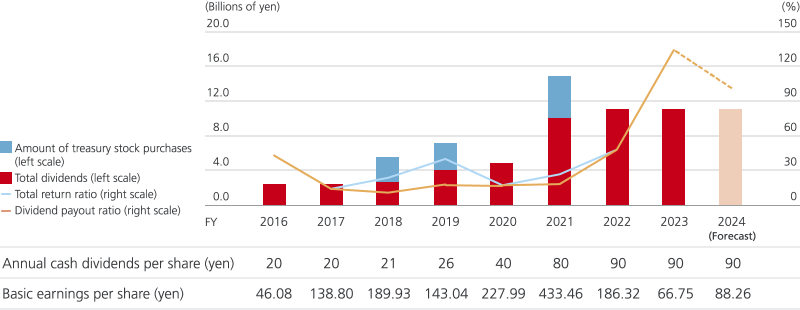

Shareholder Returns

Even though we fell short of our initial profit forecast in FY2023, we still paid an annual dividend of ¥90 as originally planned. We also plan to pay the same dividend amount in FY2024 as in the previous fiscal year. The dividend payout ratio has remained above our medium-term management plan target of 30% due to a lower profit level, but because we consider this profit level to be temporary, we have left the annual dividend intact at ¥90. For now, our goal of maintaining a stable dividend payout ratio of 30% remains unchanged, but we will consider the introduction of new indicators that are less susceptible to fluctuations in earnings.

I believe the role of our financial strategy is to support the business strategies with a view to achieving the targets of the medium-term management plan 2025, centered on our growth strategy. Even though new technologies like generative AI are giving rise to growth opportunities, we are also seeing an increase in external environmental factors that are hard to judge, including widening market cycle fluctuations and geopolitical risks. However, in my capacity as the officer in charge of finance, I will ensure that TAIYO YUDEN properly uses a metric to secure returns that exceed the cost of capital, while pressing ahead with a financial strategy to achieve the goals of the medium-term management plan 2025.